In his latest report, Wall Street Greek Technical Analyst Steven Ferguson discusses the ongoing relevance of technical analysis, despite recent market defiance of technical metrics. Ferguson speaks of interference by an invisible hand at critical junctures, but suggests investors ignore smoke and mirrors and stay attuned to the trend-line.

In his latest report, Wall Street Greek Technical Analyst Steven Ferguson discusses the ongoing relevance of technical analysis, despite recent market defiance of technical metrics. Ferguson speaks of interference by an invisible hand at critical junctures, but suggests investors ignore smoke and mirrors and stay attuned to the trend-line.Relative tickers: NYSE: DIA, NYSE: SPY, Nasdaq: QQQ, NYSE: DOG, NYSE: SDS, NYSE: QLD, NYSE: NYX, Nasdaq: NDAQ, NYSE: ICE, Nasdaq: ETFC, Nasdaq: SCHW, Nasdaq: AACC, NYSE: AMG, NYSE: AMP, Nasdaq: AMTD, Nasdaq: BGCP, NYSE: BK, NYSE: BLK, NYSE: CIT, Nasdaq: CLMS, NYSE: CME, NYSE: CNS, Nasdaq: COWN, Nasdaq: DHIL, Nasdaq: DLLR, Nasdaq: DUF, Nasdaq: ECPG, Nasdaq: EF, NYSE: EFX, Nasdaq: EPHC, NYSE: EVR, Nasdaq: EZPW, Nasdaq: FBCM, Nasdaq: FCFS, NYSE: FII, NYSE: FMD, NYSE: FNF, Nasdaq: FNGN, Nasdaq: FXCM, NYSE: GBL, Nasdaq: GCAP, Nasdaq: GDOT, Nasdaq: GFIG, NYSE: GHL, Nasdaq: GLCH, NYSE: GS, Nasdaq: IBKR, Nasdaq: INTL, Nasdaq: INTX, NYSE: ITG, NYSE: IVZ, NYSE: JEF, NYSE: JMP, NYSE: JNS, NYSE: KBW, NYSE: KCG, NYSE: LAZ, NYSE: LM, Nasdaq: LPLA, AMEX: LTS, NYSE: MA, NYSE: MCO, NYSE: MF, NYSE: MGI, Nasdaq: MKTX, Nasdaq: MRLN, NYSE: MS, Nasdaq: MSCI, NYSE: MTG, Nasdaq: NEWS, NYSE: NFP, NYSE: NNI, Nasdaq: NTRS, Nasdaq: NTSP, NYSE: OCN, NYSE: OPY, Nasdaq: OXPS, Nasdaq: PICO, NYSE: PJC, NYSE: PMI, Nasdaq: PNSN, Nasdaq: PRAA, NYSE: RJF, Nasdaq: SEIC, NYSE: SF, NYSE: SFE, NYSE: STT, NYSE: SWS, Nasdaq: TROW, NYSE: V and Nasdaq: VRTS.

Smoke and Mirrors

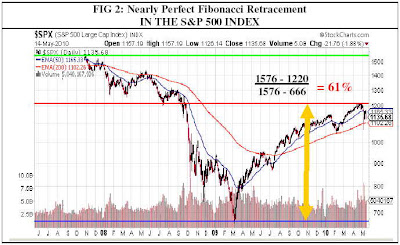

Once again, market indices sit at a critical juncture. Since July 2010 and until last week, prices have traded within the trend channel similar to the one depicted in Figure 1 below. As annotated by the arrow labeled "A," the S&P closing price has recently dropped outside that channel, has since retested the lower boundary, and presently remains slightly below that level at $1300.61.

Furthermore, Friday’s close lies tenuously above the April 18th low of $1294.70 annotated by arrow "B" in the chart. A decisive break below $1294 would likely lead to a further correction of 3-5% in the near term and could very possibly signify that the often-anticipated top to the bear market rally occurred with the May peak and is already in place.

However, each time indices have reached such a level, it seems a not-so Invisible Hand has intervened to support asset prices and (ostensibly) prevent illiquidity. Often such intervention occurs during a Globex trading session, very often on a Sunday night when trading volume can be especially thin. Despite foreboding technical indicators, the market somehow defies gravity and resumes its multi-year rally against the backdrop of a carefully-orchestrated economic mirage.

Thus technical analysis, particularly analysis that has been founded on Elliot Wave, seems to be confounded by unnatural market forces, surreptitious intervention and even high frequency trading algorithms. This would seem to be a plausible outcome since the existence of wave patterns identified by Elliot Wave theory is predicated upon predominant action and reaction of human participants in the context of a free market.

However, EW’s Prechter and others insist (for example) that, because computers are programmed by humans based on their own understanding of market action, Elliot Wave patterns can still accurately capture and anticipate market price movements. And since the FED is like any other market respondent, it cannot hope to offset the eventual behavior of market masses through its policy decisions and monetary countermeasures. Nevertheless, EW practitioners have been forced to interpret rules in more obscure ways in order to accommodate these increasingly invasive and unnatural market forces.

So where does that leave technical analysis in general and Elliot Wave in particular? Should we abandon it? Should we ignore the signposts that it often provides?

The answer is a resounding "No!" Instead, we may confidently continue to use technical analysis as a basis for shorter-term trading and as a tool to optimize the timing of longer-term investment decisions.

In particular:- Technical analysis can be used to identify high probability outcomes in various time frames. The prediction of these outcomes does not eliminate the likelihood that lower probability outcomes will occur. The key is to identify the important price levels and respond appropriately when those levels are achieved or violated. In the present case, the author has a modest short position in June S&P futures with the expectation that prices could break key support of 1290. A decisive rise above 1306 would lead me to cover my short position.

- Technical analysis seems more effective as a basis for short-term trading and for localized timing of longer-term investment decisions. A review of recent articles in this column would reveal that, although we may not have been able to identify the market top, each prediction has correctly warned of a significant price move. Furthermore, as we approach our third significant market top in a little over a decade, it would seem that such market timing is increasingly important. Particularly in the age of high-frequency trading promulgated largely by the investment banks, buy-and-hold may no longer provide a viable investment strategy. This increases the importance in awareness and interpretation of key technical indicators.

- The principles that underlie Elliot Wave theory remain valid, particularly the emphasis on analytical understanding of crowd behavior. While identification of specific wave patterns can be problematic, Elliot Wave also emphasizes the measurement of market sentiment with the basic notion that extreme values foretell reversal. Such has been the case recently with precious metals, especially silver. With so many traders and retail investors scrambling to speculate on the price of silver, a significant drop was imminent. The recent drop in silver likely signifies just the beginning of the correction in the commodities bubble as a whole.

- Economic fundamentals remain an important back drop to technical analysis. Through his own cogent evaluation of economic indicators, the Greek has often exposed the fallacy in popular views of economic growth. Even though the FED may continue to intervene with QE3, QE4 …QEx, and the US Government (indeed all governments worldwide) may continue to raise debt ceilings in their vain efforts to preserve public spending through taxpayer indebtedness, it is painfully obvious that these measures have largely failed to solve basic problems in housing, credit and unemployment.

Therefore, this is no time for complacency, even in long-term investments! The author urges readers to remain alert for signs of technical weakness. The Greek will continue to provide an important source of early warning for our readership.

Article should interest investors in SPDR Dow Jones Industrial Average (NYSE: DIA), SPDR S&P 500 (NYSE: SPY), PowerShares QQQ Trust (Nasdaq: QQQ), ProShares Short Dow 30 (NYSE: DOG), ProShares Ultra Short S&P 500 (NYSE: SDS), ProShares Ultra QQQ (NYSE: QLD), NYSE Euronext (NYSE: NYX), The NASDAQ OMX Group (Nasdaq: NDAQ), Intercontinental Exchange (NYSE: ICE), E*Trade Financial (Nasdaq: ETFC), Charles Schwab (Nasdaq: SCHW), Asset Acceptance Capital (Nasdaq: AACC), Affiliated Managers (NYSE: AMG), Ameriprise Financial (NYSE: AMP), TD Ameritrade (Nasdaq: AMTD), BGC Partners (Nasdaq: BGCP), Bank of New York Mellon (NYSE: BK), BlackRock (NYSE: BLK), CIT Group (NYSE: CIT), Calamos Asset Management (Nasdaq: CLMS), CME Group (NYSE: CME), Cohn & Steers (NYSE: CNS), Cowen Group (Nasdaq: COWN), Diamond Hill Investment (Nasdaq: DHIL), Dollar Financial (Nasdaq: DLLR), Duff & Phelps (Nasdaq: DUF), Encore Capital (Nasdaq: ECPG), Edelman Financial (Nasdaq: EF), Equifax (NYSE: EFX), Epoch (Nasdaq: EPHC), Evercore Partners (NYSE: EVR), EXCorp. (Nasdaq: EZPW), FBR Capital Markets (Nasdaq: FBCM), First Cash Financial (Nasdaq: FCFS), Federated Investors (NYSE: FII), First Marblehead (NYSE: FMD), Fidelity National Financial (NYSE: FNF), Financial Engines (Nasdaq: FNGN), FXCM (Nasdaq: FXCM), Gamco Investors (NYSE: GBL), GAIN Capital (Nasdaq: GCAP), Green Dot (Nasdaq: GDOT), GFI Group (Nasdaq: GFIG), Greenhill (NYSE: GHL), Gleacher (Nasdaq: GLCH), Goldman Sachs (NYSE: GS), Interactive Brokers (Nasdaq: IBKR), INTL FCStone (Nasdaq: INTL), Intersections (Nasdaq: INTX), Investment Technology (NYSE: ITG), Invesco (NYSE: IVZ), Jefferies (NYSE: JEF), JMP Group (NYSE: JMP), Janus Capital (NYSE: JNS), KBW (NYSE: KBW), Knight Capital (NYSE: KCG), Lazard (NYSE: LAZ), Legg Mason (NYSE: LM), LPL Investment (Nasdaq: LPLA), Ladenburg Thalmann (AMEX: LTS), Mastercard (NYSE: MA), Moody’s (NYSE: MCO), MF Global (NYSE: MF), Moneygram (NYSE: MGI), MarketAxess (Nasdaq: MKTX), Marlin Business Services (Nasdaq: MRLN), Morgan Stanley (NYSE: MS), MSCI (Nasdaq: MSCI), MGIC Investment (NYSE: MTG), NewStar Financial (Nasdaq: NEWS), National Financial Partners (NYSE: NFP), Nelnet (NYSE: NNI), Northern Trust (Nasdaq: NTRS), NetSpend (Nasdaq: NTSP), Ocwen Financial (NYSE: OCN), Oppenheimer (NYSE: OPY), optionsXpress (Nasdaq: OXPS), PICO (Nasdaq: PICO), Piper Jaffray (NYSE: PJC), PMI Group (NYSE: PMI), Penson Worldwide (Nasdaq: PNSN), Portfolio Recovery (Nasdaq: PRAA), Raymond James (NYSE: RJF), SEI Investments (Nasdaq: SEIC), Stifel Financial (NYSE: SF), Safeguard Scientifics (NYSE: SFE), State Street (NYSE: STT), SWS (NYSE: SWS), T. Rowe Price (Nasdaq: TROW), Visa (NYSE: V) and Virtus Investment Partners (Nasdaq: VRTS).

Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Labels: Editors_Picks, Ferguson, Market-Outlook, Technical_Analysis

.png)