Perception could be reality as the month unfolds here. Investors fattened up in 2014 are cautious here in 2015 and weary of risks tied to energy’s too quick decline, dollar damage to multinationals’ overseas income, Russian tensions and the possibility of terrorism here at home. It did not help that well-respected Goldman Sachs said a correction is likely here at the start of the year. Let me be clear, though, there are serious risks to worry about now and I do not expect the VIX to soften anytime soon. You’ll want to lay off multinationals and momentum here to start the year, and continue to work gold. However, I am taking close looks at recently beaten down Greece and energy for important inflection points. I saw it in Greece but did not get it to pen fast enough for you, though there should be further profit opportunity. One of my favorite stock names, Ambarella (Nasdaq: AMBA), took off as well before I could publish on it, but I needed some time off and took it. I’m back now, so please do stay close (WallStreetGreek).

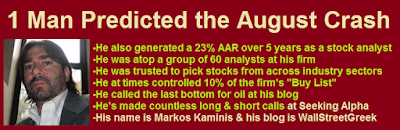

Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.

Security

|

YTD

|

TTM

|

SPDR S&P 500 (NYSE: SPY)

|

-0.6%

|

+13.1%

|

SPDR Dow Jones (NYSE: DIA)

|

-0.4%

|

+10.3%

|

PowerShares QQQ (Nasdaq: QQQ)

|

-0.3%

|

+19.3%

|

SPDR Gold Shares (NYSE: GLD)

|

+2.8%

|

-2.5%

|

iPath S&P Crude Oil (NYSE: OIL)

|

-8.9%

|

-48.7%

|

PIMCO Total Return (Nasdaq: BOND)

|

+0.7%

|

+7.0%

|

PowerShares DB US $ Bullish (NYSE: UUP)

|

+0.7%

|

+12.5%

|

iPath S&P VIX ST Futures (NYSE: VXX)

|

+3.2%

|

-21.7%

|

Stocks have started the year with a heavy dose of volatility. Last week marked the first full week of trading, and it saw a sharp reversal of early year trading losses. Goldman Sachs (NYSE: GS) says it expects a significant decline for stocks over the next 4 to 6 weeks, though, due to extreme positive sentiment at the turn of the year. Oftentimes perception becomes reality, and a few money monkeys (financial market pundits) have already turned tail. Don’t fight the fear just yet, as this latest terrorism event in Paris has the potential of spreading contagious destructive inspiration to demented losers on U.S. shores. While we want to be contrarians, let’s not get run over by the herd either friends.

The Week Ahead

The economic schedule this week holds a few market-moving morsels for the market to chew on. While the NFIB Small Business Optimism Index should garner most of the attention on Tuesday, I would not look to it for guidance. Small businessmen are likely to be politically influenced, as the current administration has forced it to adapt to a higher cost structure. Where some have adapted and altered the structure of workforce to manage healthcare costs, others are simply bearing the weight and growing agitated. I anticipate a generally negative sentiment or skewed qualitative discussion from the group as a result through the 2016 election. Tuesday morning’s job openings data could prove useful. Job openings have improved significantly over the past year and economists expect the latest check to reflect that trend.

Wednesday’s retail sales data will show healthy growth before inclusion of gasoline sales, which will obviously be influenced by lower gas prices. This will force market participants to again think about the positives around lower energy prices, as will Alcoa’s (NYSE: AA) earnings report Tuesday. Industrials are energy sensitive, and Alcoa could be the first to really talk about significantly widened profit margins on energy cost decrease. Investors will want to also pay attention to the Fed Beige Book and Philly Fed President Plosser’s public appearance for market drivers; Plosser is a notorious hawk. The Atlanta Fed’s business inflation measure could color the market’s view as well, as could export and import price data. Import prices are going to reflect lower oil prices.

Manufacturing data due on Thursday should sway the day, with the Philadelphia and New York regional measures making the market. Healthy figures are expected to show continued U.S. manufacturing expansion and business activity in the Northeast. The Producer Price Index is due Thursday as well, and we will look past the headline figure to Core PPI to get an energy free perspective. Only mild price increase is expected here.

Friday offers the consumer level Consumer Price Index, and the Core CPI is likewise expected to only produce mild price rise. Dollar influence matters here now for price measures, so we may be misinterpreting what could be temporary benefit, but the market is not yet thinking this way. I’ll have more to say on the subject in the future. Consumer sentiment data is supposed to show improvement, and we would be fools to expect anything less given the sharp decrease in gas prices. Industrial production data is also due Friday, so there will be no rest for the weary as we close out the week.

THIS WEEK’S ECONOMIC REPORT

SCHEDULE

|

Economic Data Point

|

Prior

|

Expected

|

MONDAY

|

|

|

|

|

|

|

Japan Market Closed

|

|

|

TUESDAY

|

|

|

|

|

|

|

|

|

98.1

|

98.1

|

|

|

|

|

-Year-to-Year Pace

|

|

|

|

|

|

|

|

|

4.834M

|

4.875M

|

|

|

-$56.8B

|

$3.0B

|

|

|

|

|

|

|

|

|

WEDNESDAY

|

|

|

|

|

+0.7%

|

-0.1%

|

-Less Autos & Gas

|

+0.6%

|

+0.6%

|

|

|

|

|

|

|

|

|

-Crude Oil Inventory

|

|

|

-Gasoline Inventory

|

|

|

|

|

+0.2%

|

+0.3%

|

|

|

-1.0%

|

-0.5%

|

-Import Prices

|

-1.5%

|

-2.7%

|

|

|

|

|

|

|

|

|

|

|

|

|

THURSDAY

|

|

|

|

|

-0.2%

|

-0.4%

|

-Core PPI

|

+0.0%

|

+0.1%

|

|

|

-3.58

|

+5.0

|

|

|

24.5

|

20.0

|

|

|

294K

|

295K

|

|

|

|

|

|

|

|

|

FRIDAY

|

|

|

|

|

-0.3%

|

-0.4%

|

-Core CPI

|

+0.1%

|

+0.1%

|

|

|

+1.3%

|

-0.1%

|

-Capacity Utilization

|

80.1%

|

80.0%

|

|

|

|

|

|

|

93.6

|

94.0

|

|

|

|

|

The earnings schedule will bring a focus to the start of the season. Alcoa kicks things off, and the big financials begin to report as the week progresses. Look for important news from Bank of America (NYSE: BAC), Citigroup (NYSE: C), Wells Fargo (NYSE: WFC), J.P. Morgan Chase (NYSE: JPM) and Goldman Sachs (NYSE: GS). I wonder if we’ll get our next big capacity cut and layoff news from the energy sector when Schlumberger (NYSE: SLB) reports on Thursday. Homebuilder K.B. Home (NYSE: KBH) will garner some attention this week as well, but investors will want to pay close attention to regional influences on various builders; I’ll talk more on this subject in the future, but I’m referring to recession in Texas.

HIGHLIGHTED EPS REPORTS

|

Company

|

Ticker

|

MONDAY

|

|

Affymetrix

|

Nasdaq: AFFX

|

Alcoa

|

NYSE: AA

|

American Realty Capital

|

Nasdaq: ARCP

|

Castlight Health

|

Nasdaq: CSLT

|

China Bak Battery

|

Nasdaq: CBAK

|

dELiA*s

|

Nasdaq: DLIAQ

|

Knowles

|

NYSE: KN

|

ONE Gas

|

NYSE: OGS

|

SemiLEDs

|

Nasdaq: LEDS

|

SYNNEX

|

NYSE: SNX

|

Washington Federal

|

Nasdaq: WAFD

|

TUESDAY

|

|

Boston Private Financial

|

Nasdaq: BPFH

|

Ceres

|

Nasdaq: CERE

|

CSX

|

NYSE: CSX

|

IHS

|

NYSE: IHS

|

K.B. Home

|

NYSE: KBH

|

Kinder Morgan

|

NYSE: KMI

|

Linear Technology

|

Nasdaq: LLTC

|

M.B. Financial

|

Nasdaq: MBFI

|

Progress Software

|

Nasdaq: PRGS

|

WEDNESDAY

|

|

Wells Fargo

|

NYSE: WFC

|

CLARCOR

|

NYSE: CLC

|

Greif

|

NYSE: GEF

|

H.B. Fuller

|

NYSE: FUL

|

J.P. Morgan Chase

|

NYSE: JPM

|

Nord Anglia Education

|

Nasdaq: NORD

|

Westamerica Bancorp

|

Nasdaq: WABC

|

THURSDAY

|

|

AEP Industries

|

Nasdaq: AEPI

|

Bank of America

|

NYSE: BAC

|

Bank of Ozarks

|

Nasdaq: OZRK

|

BlackRock

|

NYSE: BLK

|

Charles Schwab

|

Nasdaq: SCHW

|

Citigroup

|

NYSE: C

|

Commerce Bancshares

|

Nasdaq: CBSH

|

Fastenal

|

Nasdaq: FAST

|

First Republic Bank

|

NYSE: FRC

|

Home BancShares

|

Nasdaq: HOMB

|

Intel

|

Nasdaq: INTC

|

Lennar

|

NYSE: LEN

|

M&T Bank

|

NYSE: MTB

|

People’s United Financial

|

Nasdaq: PBCT

|

PPG Industries

|

NYSE: PPG

|

Schlumberger

|

NYSE: SLB

|

Wintrust Financial

|

Nasdaq: WTFC

|

WNS

|

NYSE: WNS

|

FRIDAY

|

|

Comerica

|

NYSE: CMA

|

Goldman Sachs

|

NYSE: GS

|

PNC Financial

|

NYSE: PNC

|

PrivateBancorp

|

Nasdaq: PVTB

|

SunTrust Banks

|

NYSE: STI

|

Other reports you should read:

Gold Outlook for 2015 – Buy and Hold Here

Market Outlook for 2015

Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Labels: Market-Outlook, Market-Outlook-2015-Q1, Week-Ahead, Week-Ahead-2015