Technical Indicators Revisited

Wall Street Greek technical analyst Steven Ferguson offers his latest technical analysis and market outlook below. Mr. Ferguson suggests the end of the bear market rally may be at hand, and if the conditions he lays out fall into place, a fall to the 900 mark on the S&P 500 Index is a real possibility. It is important to note that Mr. Ferguson produced this latest review of technical indicators for us this past Sunday, and updated the data before the market opened on May 18. The major indices have since completed their short-term rally and touched their respective 200 day moving averages as forecast.

Wall Street Greek technical analyst Steven Ferguson offers his latest technical analysis and market outlook below. Mr. Ferguson suggests the end of the bear market rally may be at hand, and if the conditions he lays out fall into place, a fall to the 900 mark on the S&P 500 Index is a real possibility. It is important to note that Mr. Ferguson produced this latest review of technical indicators for us this past Sunday, and updated the data before the market opened on May 18. The major indices have since completed their short-term rally and touched their respective 200 day moving averages as forecast.(Tickers: NYSE: EDZ, NYSE: DIA, NYSE: SPY, Nasdaq: QQQQ, NYSE: DOG, NYSE: SDS, NYSE: QLD, NYSE: NYX, NYSE: ICE, Nasdaq: NDAQ)

Technical Indicators

On Labor Day of last year, the Greek published my article highlighting a technical charting pattern that had appeared in most major stock indices at that time: a bullish (inverse) Head & Shoulders. I was admittedly skeptical that the current bear market rally would take prices high enough to complete the pattern, particularly within the time frame demanded by a strict interpretation of related criteria for the price target. Turns out that, while I may have been correct about the timing I was ultimately wrong about the eventual level.

On Labor Day of last year, the Greek published my article highlighting a technical charting pattern that had appeared in most major stock indices at that time: a bullish (inverse) Head & Shoulders. I was admittedly skeptical that the current bear market rally would take prices high enough to complete the pattern, particularly within the time frame demanded by a strict interpretation of related criteria for the price target. Turns out that, while I may have been correct about the timing I was ultimately wrong about the eventual level.On April 26th of 2010, the S&P 500 (cash index) hit a high price of 1219.80, approximately 30 points shy of the nominal 1250 target highlighted in our previous article (see Figure 1 below). Note that a slightly more precise calculation of that target would have produced a refined value of 1220, which would make the intraday high remarkably close to the projection.

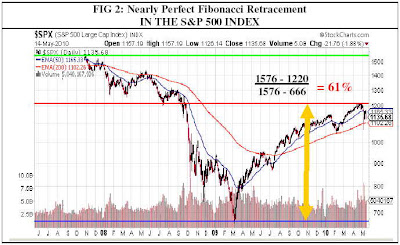

As well, another important technical condition may have also been satisfied on April 26th with the near completion of a textbook 61.8% Fibonacci Retracement. Both the DOW Industrials as well as the S&P 500 completed such a near-perfect retracement on that date (see Figure 2 below), recovering approximately 61% of the value lost between the October 2007 high and March 2009 bear market low. Readers may recall the significance of Fibonacci numbers in (human) behavioral processes from a previous installment of our series on technical analysis.

So does the culmination of these two important technical events suggest that the bear market rally is over? At the risk of being labeled as a Perma-Bear Analyst who thrice cried "Wolf," I dare say this may be the case. But let us continue to examine the facts.

During the recent Fat-fingered Flash Crash, major indices not only broke through their 50 day exponential moving averages (EMA), but also dropped briefly below the more important 200 day mark. Moreover, indices have failed to break back above what now appears to be 50EMA resistance and seem bound to retest the longer-term 200 day average in the near future. This "bears" watching closely!

Looking also at the averages on a weekly time frame, we again see some important conditions afoot. Note that the major indices fell below their 13-week EMA for only the second time since the onset of bull market conditions. As long as indices remain bounded by the 34-week EMA support, the rally may indeed continue longer.

However, if the 13 week EMA were to cross back below the 34 week EMA, Bear Market conditions would again prevail, this time with a much lower likelihood of intervention by governments and central banks the world over. It is worth pointing out that these weekly indicators have provided a reasonably accurate segregation of market conditions for many instances in the past, notably marking the onset of the Bear Market in late 2007 as well as the return to low-volatility, Bullish conditions in July of 2010.

Last, Elliot Wave Theory once again points to a strong possibility that Wave B, the rally-phase of the Bear Market, completed on April 26th. The current wave structure suggests that the first minor wave of Wave C down began with the Flash Crash as sub-wave 1, continued with a brief 50 point respite rally at the onset of sub-wave 2, and will continue with sub-wave 3 set to begin early next week. A convincing break above 1160 on the S&P index would suggest the prevailing bearish wave count might be incorrect, and that we might hit one more recovery high before summer's end. A close below the 200 day EMA would reinforce the reality that we are instead heading back to the 900 level over the next few months.

How should Greek readers respond in these "emerging" conditions? Once again, I believe it is prudent to raise cash. Given the underlying, farcical macro-economic conditions and ever-more-tenuous political landscape across the globe, with headwinds from alarming debt, inevitable taxation, imminently higher interest rates, recalcitrant joblessness, dwindling stimulus, …even fallout from both natural and manmade disasters, … readers may choose to take a more aggressive approach. To that end, I might be inclined to join Jim Rogers in his recent short position in emerging markets. In particular, readers may be interested in looking at (NYSEArca: EDZ), an ultra-bear emerging market ETF as a means to hedge the current downside risk.

Article may interest investors in Nasdaq: MEMKX, Nasdaq: GECMX, Nasdaq: JEVOX, Nasdaq: PEMAX, NYSE: EEM, NYSE: VWO, Nasdaq: VEIEX, Nasdaq: ADRE, Nasdaq: PEBIX, Nasdaq: GMCEX, NYSE: MSF, NYSE: EEV, Nasdaq: REMGX, NYSE: GMM, NYSE: EDZ, AMEX: ETF, NYSE: FEO, NYSE: ESD, NYSE: MSD, NYSE: EMF, NYSE: TEI, Nasdaq: EMIF, NYSE: EFN, NYSE: EMT, NYSE: PCY, NYSE: PXH, NYSE: GMF, NYSE: GUR, NYSE: GML, NYSE: GMM, NYSE: EWX, NYSE: GAF, NYSE: EUF, NYSE: EET, Nasdaq: ABEMX, Nasdaq: AEMGX, Nasdaq: APERX, Nasdaq: PMGAX, Nasdaq: PMCIX, Nasdaq: AOTAX, Nasdaq: AOTCX, Nasdaq: AOTDX, Nasdaq: AEMPX, Nasdaq: AOTIX, Nasdaq: AEMEX, Nasdaq: AAMRX, Nasdaq: AEMFX, Nasdaq: AAEPX, Nasdaq: AEMMX, Nasdaq: ACKBX, Nasdaq: ACECX, Nasdaq: AMKIX, Nasdaq: TWMIX, Nasdaq: NDAQ, NYSE: PIZ, NYSE: PIE, NYSE: PDP, NYSE: DIA, NYSE: SPY, NYSE: NYX, NYSE: DOG, NYSE: SDS, NYSE: QLD, NYSE: IWM, NYSE: TWM, NYSE: IWD, NYSE: SDK, NYSE: ICE, Nasdaq: QQQQ, Nasdaq: HTOAX, Nasdaq: HTOTX, Nasdaq: HTOBX, Nasdaq: JTCIX, Nasdaq: JTCNX, Nasdaq: JTCAX.

Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Labels: Ferguson, Technical_Analysis

2 Comments:

I think (considering EMA) that it's all likely to do an upswing with a surprise bull result and I agree that you were right about the timing and yet off on the level. But I think it will follow your suggested pattern, just not for another two years.

Thanks for your comment Ramsey

It will be interesting to watch this unfold

I just don't see how governments can afford the (Keynesian) intervention necessary to continue inflating assets here. Even if they could afford it, their constituency won't support it. And even if they could garner such support, excess printed money will only add to future economic headwinds: inflation, taxes and interest rates

Good luck with your trading! And thanks again for your comment

Post a Comment

<< Home