When Apple (Nasdaq: AAPL) entered the mobile phone market, it had no presence and yet followed through to change the game for the electronics segment. With the

iPad

and iPhone, Apple has changed the way we think about our web surfing, opening up computing to a slew of new hardware possibilities. The company did the same thing for mobile music, and I propose, it is capable of changing the game yet again, this time for television. The Apple television solution, however it may develop, should be the driver for the next leg of mind-blowing growth for this innovator of our age. At the same time, I believe that how Apple proceeds could determine whether its age of innovation has peaked, or whether it goes on.

Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.

In television, Apple will find no lack of competition. The deeply embedded list of experienced players includes iconic electronics producers and some companies that Apple is already butting heads with. The leading large-screen brands globally in terms of market share based on Q1 2012 revenues are Samsung (KSE: 005930.KS), LG (KSE: 003550.KS), Sony (NYSE: SNE), Sharp (OTC: SHCAY.PK) and Panasonic (NYSE: PC).

So Apple finds its arch-nemesis, Samsung (OTC: SSNLF.PK), which it recently battled in patent court, atop the list in television sets. Samsung is not sitting idle either, having already introduced a

Smart-TV of its own, striking before Apple could introduce a model. Samsung has built on what it has learned works in its experience competing with Apple in mobile phones. Yet, I still believe Apple can become the leading player in televisions. Why?

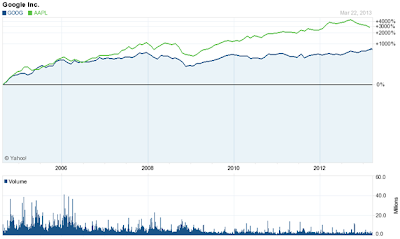

It is not as if innovation was not already present in the mobile phone industry when Apple entered it, and yet Steve Jobs’ vision was still able to revolutionize it. Motorola (later Motorola Mobility), which was acquired by Google (Nasdaq: GOOG) not too long ago, was flattening the phone and Nokia (NYSE: NOK) and everybody else were shrinking it and adding features, including cameras. Yet, Apple came in with an exciting new idea, a fresh look and two brands people respected, Apple and Steve Jobs, and it earned the demand of the market. Its latest mobile conquest has been in a last bastion of mobile dominated by one of its rivals. Research in Motion (Nasdaq: RIMM) had dominated the business market, and yet today it is struggling to keep from following the fate of Palm, which was acquired by Hewlett-Packard (NYSE: HPQ) before it could fail. However staggered, the competition is arguably catching up in mobile phones now, and Apple will need a new front to keep its stunning growth going.

Presumably, Apple will do a little of the same innovating in its television development. Though without Jobs at the helm, one must question whether it will be as clairvoyant in its vision. Even with Jobs, Apple may have been over-thinking television. Certainly Apple could have had a smart television on the market long ago, but the company wants to provide more than what other smart TVs are offering today. Jobs’ vision was that the Apple television should offer both new content and new access to existing content for it to be disruptive enough to change the game. However, the company has run into roadblocks in its discussions with content and cable providers like Time Warner Cable (NYSE: TWC) and Comcast (Nasdaq: CMSCA), which have been skeptical and cautious about letting Apple into their realm. It’s understandable, considering Apple’s impact upon some of the players in other fields. The trick is in getting the cable providers to see themselves like the communications companies in mobile, the AT&T’s (NYSE: T), Sprint Nextel’s (NYSE: S) and Verizon’s (NYSE: VZ) of the world, and not like the decimated mobile phone makers.

However, even without the degree of disruption Apple wants, it still could dominate television, in my view. That’s because whatever Apple may today be missing in creativity and persuasion without its iconic visionary, this time, should be offset by the draw of its strong brand name and its excellent reputation. So the company could be missing an opportunity and possibly a stepping stone toward its end goal for as long as it stays out of the television market. Or, it could be smartly controlling its image in television, and keeping from weakening its future role by waiting. The evolution of television is complex and developing, and offers a range of scenarios for companies of all sorts, including those already mentioned and the likes of Netflix (Nasdaq: NFLX), TiVo (Nasdaq: TIVO), DirecTV (NYSE: DTV), Amazon.com (Nasdaq: AMZN), Google (Nasdaq: GOOG) and Microsoft (Nasdaq: MSFT).

Television sets have been viewed as a commodity for so long now, that no manufacturer has yet been able to establish its brand as a destination driver. In other words, I do not believe people go to Best Buy (NYSE: BBY) to buy a Samsung Smart TV. This is proven by consumers’ defining televisions by their features, rather than by their brand names. You hear people talking about their flat screen TV, not their Samsung TV. The newest technological nuance has been 3D technology, but I expect that if you surveyed consumers, very few could definitely tell you which brand they like best in 3D. People assume that everybody makes one, and so they decide on which to buy while shopping; and based on their store experience, TV image quality at viewing, consumer reviews and on price.

Yet, if Apple enters the fray, even with a less powerful offering than the company targets, I feel comfortable saying Americans will stampede for their latest Apple toy. The fact that smart televisions already existed before Apple entered the market would be quickly forgotten. I expect an Apple television would instantaneously become a market share leader, if not the top player. Perhaps only price would slow its rise to the top in TVs, but only as much (or as little) as it has slowed its stellar growth in other segments. Apple has proven that enough people will pay up for a better solution. Analyst Peter Misek at Jefferies & Company, figures an Apple television priced at $1,250 would have generated $2.5 billion in sales in the fourth quarter of this year. That’s about 6.9% of what Apple is currently projected to make in fiscal Q4 (Sept.) without a television. It’s not negligible, but it’s not blockbuster either, though I believe it is understated.

Apple’s valuation has for some time now reflected skepticism about whether the company could continue to grow at its amazing pace as it comes against the law of large numbers. I broached this subject in my article entitled

“Should I Buy Apple?” Apple’s high stock price has drawn questions as to whether a stock split could add value or not, and I covered

the pros and the

cons of a potential Apple stock split in recent works as well. But if Apple could provide investors with a viable new vehicle for growth, some of its valuation gap would narrow, adding fuel to capital appreciation that would also benefit from boosted EPS growth.

Today, AAPL shares trade at a P/E ratio of about 11.8X the analysts’ consensus EPS estimate of $53.45 for fiscal year 2013 (Sept.). That compares to analysts’ projected five-year growth expectations of 24%, giving the stock a P/E-to-growth ratio of 0.5. It’s apparent here that there is some skepticism with regard to the company’s ability to grow at the estimated pace. Investors betting on the company’s follow through would thus have a margin of safety to play with. Furthermore, if the company can successfully enter a new market segment like television, I expect it would prove those investors right. My expectations for television are an important reason why I favor AAPL shares today, especially at the stock’s valuation. Still, how well Apple capitalizes on its opportunity is completely dependent on the execution of its Jobs-less management team.

As I have determined to pick up regular coverage of Apple for investors, you may want to stay in the loop by following my column.

Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Labels: AAPL, INDUSTRY-Personal-Computers, SECTOR-Technology, Stock-Picks-2012-Q4, Stocks, Stocks-2012-Q4