Will Google Fall if Apple Rises?

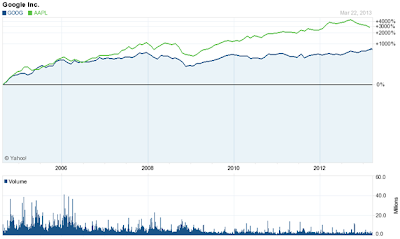

A comment posted to a recent report of mine suggested that Google (Nasdaq: GOOG) and Apple (Nasdaq: AAPL) shares might be negatively correlated. In other words, the reader suggested that Google has benefited from Apple’s weakness since December. I thought it to be an interesting theory worthy of further review, and so we explore that here. Because I believe AAPL will eventually rise again, we especially want to know if AAPL rises, will GOOG fall?

Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.

Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.

The six-month chart comparison of the two behemoths of technology does seem to indicate negative correlation of returns. The deviation of the two stocks seems to pick up steam in mid-December.

The one-year chart here adds some color as well, because it shows the two stocks were probably positively correlated, or at least each correlated to the broader market before December. Apple diverged from the market as well in December, which was painfully obvious to Apple shareholders. Apple should have followed the market higher, since it carries a beta coefficient of 0.74. Google’s beta is 1.18, and so it should exaggerate market moves. Apple has clearly marched to the beat of its own drummer over the last several years, but historically, that march was to its benefit against a weaker market performance.

It’s certainly possible that Apple’s decline is completely unrelated to Google’s rise. Because around the time it began lower, market chatter was expressing concern about a possible increase to the capital gains tax rate. Long-time holders of Apple may have taken gains before the turn of the year in order to avoid paying higher taxes in the future. There is a critical flaw in that argument though since Google’s long-term performance is also pretty good. So there might have been selling in GOOG around that time for the same reason.

The only reason one might think the two could be correlated is due to capital flows, and the similarities of the companies in terms of sector participation, market capitalization and trading volume. Apple dominates most companies in each of those last two categories, and it dominates Google as well. However, Google shares have heavy enough volume to support the demand of big institutional investors who may have needed something interesting in technology to replace Apple holdings over recent months.

Even if that were the case, as time passes and given new valuation considerations, any negative correlation would dissolve. In my opinion, the two companies each offer interesting long-term opportunity for investors in stocks because of the importance of their goods and services in the marketplace and their ongoing prospects. Furthermore, I believe each should be included in the space allotted to technology within diversified portfolios. Apple would seem to offer the best value with its PEG ratio of 0.5X, but the stock’s valuation is due to recent questions about its ability to continue to innovate and grow. Google may seem expensive as it trades at a PEG of 1.2X, but it is introducing new electronics now, including the Google Glass, and so could pick up its growth pace. In conclusion and in answering my question, no, I do not think Google will fall if Apple rises.

This article will also interest investors in Microsoft (Nasdaq: MSFT), Samsung (OTC: SSNLF), Nokia (NYSE: NOK), Amazon.com (Nasdaq: AMZN), Facebook (NYSE: FB) and Yahoo (Nasdaq: YHOO). Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.

Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.

Google vs. Apple

The six-month chart comparison of the two behemoths of technology does seem to indicate negative correlation of returns. The deviation of the two stocks seems to pick up steam in mid-December.

The one-year chart here adds some color as well, because it shows the two stocks were probably positively correlated, or at least each correlated to the broader market before December. Apple diverged from the market as well in December, which was painfully obvious to Apple shareholders. Apple should have followed the market higher, since it carries a beta coefficient of 0.74. Google’s beta is 1.18, and so it should exaggerate market moves. Apple has clearly marched to the beat of its own drummer over the last several years, but historically, that march was to its benefit against a weaker market performance.

It’s certainly possible that Apple’s decline is completely unrelated to Google’s rise. Because around the time it began lower, market chatter was expressing concern about a possible increase to the capital gains tax rate. Long-time holders of Apple may have taken gains before the turn of the year in order to avoid paying higher taxes in the future. There is a critical flaw in that argument though since Google’s long-term performance is also pretty good. So there might have been selling in GOOG around that time for the same reason.

The only reason one might think the two could be correlated is due to capital flows, and the similarities of the companies in terms of sector participation, market capitalization and trading volume. Apple dominates most companies in each of those last two categories, and it dominates Google as well. However, Google shares have heavy enough volume to support the demand of big institutional investors who may have needed something interesting in technology to replace Apple holdings over recent months.

Even if that were the case, as time passes and given new valuation considerations, any negative correlation would dissolve. In my opinion, the two companies each offer interesting long-term opportunity for investors in stocks because of the importance of their goods and services in the marketplace and their ongoing prospects. Furthermore, I believe each should be included in the space allotted to technology within diversified portfolios. Apple would seem to offer the best value with its PEG ratio of 0.5X, but the stock’s valuation is due to recent questions about its ability to continue to innovate and grow. Google may seem expensive as it trades at a PEG of 1.2X, but it is introducing new electronics now, including the Google Glass, and so could pick up its growth pace. In conclusion and in answering my question, no, I do not think Google will fall if Apple rises.

This article will also interest investors in Microsoft (Nasdaq: MSFT), Samsung (OTC: SSNLF), Nokia (NYSE: NOK), Amazon.com (Nasdaq: AMZN), Facebook (NYSE: FB) and Yahoo (Nasdaq: YHOO). Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Labels: AAPL, Editors_Picks, Editors-Picks-2013-Q2, Featured, Featured-2013-Q2, GOOG, INDUSTRY-Networking-and-Communication-Devices, SECTOR-Technology, Stock_Picks, Stocks, Stocks-2013-Q2, Syndicate

0 Comments:

Post a Comment

<< Home