Apple (AAPL) Supported by Rumors & Tricks

Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.

Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.

Apple

Before the latest share rally, your author here suggested that For Apple, No News is Bad News. Not long after that note was published, the Apple rumor mill started churning faster. First there was renewed chatter of a potential special unscheduled product announcement, with hope for news of new electronic gear like an Apple watch or the long anticipated Apple television set. The excitement was heightened because of Google’s (Nasdaq: GOOG) introduction of its Google Glass, and Samsung (OTC: SSNLF.PK) and Blackberry (Nasdaq: BBRY) introductions of their newest phones. Still, an eerie silence surrounded Apple and none of those rumors materialized.

Then, with pressure from activist investors ongoing, and as the company approached the one-year anniversary of its dividend and repurchase program announcement, popular media began speculating about a possible event for this year. The coverage was so heavy it almost seemed factual, but there was no indication from Apple that such an event was in the cards.

On the day that Samsung (OTC: SSNLF) introduced its Galaxy S IV with high hoopla and celebration, famed investor Bill Miller appeared on CNBC television before the market open and shared that he favored Apple again and had just concluded acquiring a stake. In my piece, Why Apple Rose on Samsung’s Big Day, I suggested the curious gain for Apple that day was likely attributable to the Miller interview and, I speculated, on Apple’s own share repurchases to support its stock.

But months have passed and still no news from Apple. Investors are starting to question whether the company actually has anything to say or any new product to wow America with. The next opportunity for it to wow us may not come until the company’s next earnings release, scheduled for April 23 at 5 PM ET. Even so, after the long boys have cried rally wolf so many times, who is to say the shares will rally again into the risk of another letdown. Tuesday just after the noon hour a guest on CNBC’s Halftime Report expressed his view that Apple would introduce a television in the third quarter. The stock did not budge higher from its already established gain on the day. The boys who cry for Apple to go higher are starting to be ignored already.

It’s clear by now that standing pat is not going to turn AAPL around. The company’s technology is being effectively chased down now by Samsung and Google, and perhaps less effectively by Microsoft (Nasdaq: MSFT), Blackberry (Nasdaq: BBRY), Nokia (NYSE: NOK), Amazon.com (Nasdaq: AMZN) and more. The challengers to Apple are still lining up, with Facebook (NYSE: FB) now set to launch its own mobile platform as well. No, standing atop the hill will inevitably result in Apple being knocked off the hill, because those who would do it are all around Apple now.

A capital use announcement like an increased dividend or a special dividend has the potential of backfiring on Apple, because of the message it might send. Apple Must Send the Right Message, that it is still a growth company and the innovator of our age, and not that it is a maturing company preparing to become a cash cow dividend payer. A higher dividend is a good thing, but absent of any news about where growth will come from, will probably lead the shares lower in my opinion. An increased share repurchase program could produce a different outcome, because investors might read into it about Apple’s plans for the second half of 2013.

Apple’s valuation is a support for the stock, but it does not reflect an expectation for the company to continue to grow at the pace it has managed in the past. The stock’s forward P/E of 9.9X and PEG ratio of 0.5X is expressing doubt in Apple’s growth outlook.

Goldman Sachs (NYSE: GS) removed Apple from its conviction buy list Tuesday and others are expressing concern about its non-contention in the lower priced (lower margin) phone market. Now we have to assume that the Goldman analyst has good insight, so this is a peculiar moment for him to be hedging. Still, pressure from “above” always seems to mount on analysts at precisely the wrong moment, and I speak from experience. We’re within the quiet period for the company and so the analyst is not basing anything on a discussion with management, we assume. Therefore, I do not see this as an especially important warning sign. I think he’s just lost confidence in Apple’s team as much as I have.

Still, I expect Apple to eventually produce that big product announcement, but I’m just not convinced it will be before $400. I’m losing confidence in the company’s shareholder focus, because I believe it should be more loudly hinting at its new product efforts or aggressively supporting the stock with its allotted repurchase plan. Some of this is probably occurring and is probably the very reason why the stock was up Tuesday against the Goldman cut (similarly to its rise on the day of the Samsung product release). Given the share price drop recently, I’m wondering if Apple is more focused on looking good six months from now when it tells the story about how it repurchased shares at such bargain prices, versus the focus it should have about the positions of its shareholders in the here and now. The way to support that focus is to say something about a new product, even if that product is not yet fully ready. That’s my view, and I welcome you to follow my column and tag along for more of the same. Also, business owners who see value in my insight may contact me about consulting services, as I can study, analyze and add value to businesses of all sorts and sizes. Those interested in potentially hiring me to manage a mutual fund or hedge fund portfolio may make contact as well, as nothing is beyond my consideration.

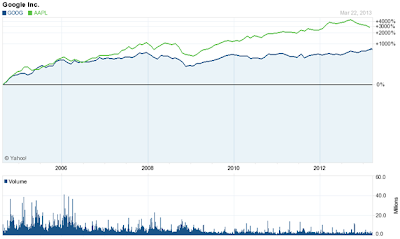

More interesting work on Apple and Google: Will Google Fall if Apple Rises?

Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Labels: AAPL, Editors_Picks, Editors-Picks-2013-Q2, Featured, Featured-2013-Q2, INDUSTRY-Networking-and-Communication-Devices, SECTOR-Technology, Stock_Picks, Stock-Picks-2013-Q2, Stocks, Stocks-2013-Q2, Syndicate