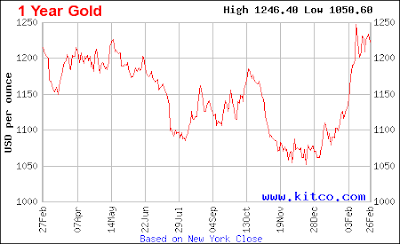

Gold – Take Profits for Now (Part I)

|

| 1-Year Spot Gold Chart from Kitco.com |

Factors that had recently served gold price appreciation are, in my view, turning and intensifying against gold through the first half of March. Thus, I recommend nimble traders take profits and sell long stakes in gold-relative securities or hedge against a downturn. I remain in favor of gold holdings for the long-term, but believe there will be a better entry point after an important reversion in gold prices toward lower levels. Click here for my full report on gold.

Precious Metal Securities

|

February to 02-26-16

|

SPDR S&P 500 (NYSE: SPY)

|

+0.7%

|

SPDR Gold Trust (NYSE: GLD)

|

+9.5%

|

iShares Gold Trust (NYSE: IAU)

|

+9.6%

|

iShares Silver Trust (NYSE: SLV)

|

+3.2%

|

Direxion Daily Gold Miners Bull 3X (NYSE: NUGT)

|

+105%

|

Market Vectors Gold Miners (NYSE: GDX)

|

+32%

|

Market Vectors Junior Gold Miners (NYSE: GDXJ)

|

+30%

|

Goldcorp (NYSE: GG)

|

+22%

|

Newmont Mining (NYSE: NEM)

|

+27%

|

Randgold Resources (Nasdaq: GOLD)

|

+26%

|

Barrick Resources (NYSE: ABX)

|

+37%

|

Silver Wheaton (NYSE: SLW)

|

+31%

|

DISCLOSURE: Kaminis is short GDX. Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only. Article should interest investors in precious metals stocks: Goldcorp (NYSE: GG), Agnico-Eagle Mines (NYSE: AEM), Allied Nevada Gold (AMEX: ANV), AngloGold Ashanti (NYSE: AU), AuRico Gold (NYSE: AUQ), Aurizon Mines (AMEX: AZK), Barrick Gold (NYSE: ABX), Brigus Gold (AMEX: BRD), Charles & Covard (Nasdaq: CTHR), Claude Resources (AMEX: CGR), Commerce Group (OTC: CGCO.PK), Compania Mina Buenaventura S.A. (NYSE: BVN), DRDGOLD (Nasdaq: DROOY), Eldorado Gold (NYSE: EGO), Entrée Gold (AMEX: EGI), Exeter Resource (AMEX: XRA), Gold Fields (NYSE: GFI), Gold Reserve (AMEX: GRZ), Gold Resource (Nasdaq: GORO), Golden Eagle Int’l (OTC: MYNG.PK), Golden Star Resources (AMEX: GSS), Great Basin Gold (AMEX: GBG), Harmony Gold (NYSE: HMY), IAMGOLD (NYSE: IAG), International Tower Hill Mines (AMEX: THM), Jaguar Mining (NYSE: JAG), Keegan Resources (AMEX: KGN), Kimber Resources (AMEX: KBX), Kingold Jewelry (Nasdaq: KGJI), Kinross Gold (NYSE: KGC), Midway Gold (AMEX: MDW), Minco Gold (AMEX: MGH), Nevsun Resources (AMEX: NSU), New Jersey Mining (OTC: NJMC.PK), Newmont Mining (NYSE: NEM), North Bay Resources (OTC: NBRI.OB), Northgate Minerals (AMEX: NXG), NovaGold Resources (AMEX: NG), Richmont Mines (AMEX: RIC), Royal Gold (Nasdaq: RGLD), Rubicon Minerals (AMEX: RBY), Seabridge Gold (AMEX: SA), Solitario Exploration and Royalty (AMEX: XPL), Tanzanian Royalty Exploration (AMEX: TRE), Thunder Mountain Gold (OTC: THMG.OB), U.S. Gold (NYSE: UXG), Vista Gold (AMEX: VGZ), Wits Basin Precious Metals (OTC: WITM.PK), Yamana Gold (NYSE: AUY), Coeur d’Alene Mines (NYSE: CDE), Endeavour Silver (NYSE: EXK), Hecla Mining (NYSE: HL), Mag Silver (AMEX: MVG), Mines Management (AMEX: MGN), Silver Standard Resources (Nasdaq: SSRI), Silver Wheaton (NYSE: SLW), SPDR Gold Trust (NYSEArca: GLD), Market Vectors Gold Miners ETF (NYSEArca: GDX), iShares Silver Trust (NYSEArca: SLV), ProShares Ultra Silver (NYSEArca: AGQ), ProShares Ultra Short Silver (NYSEArca: ZSL), Great Panther Silver (AMEX: GPL), Silvercorp Metals (NYSE: SVM), Paramount Gold and Silver (AMEX: PZG), Pan American Silver (Nasdaq: PAAS) and First Majestic Silver (NYSE: AG).

Labels: Editors_Picks, Editors-Picks-2016-Q1, Gold, Gold-2016, Gold-2016-Q1, INDUSTRY-Gold, Insightful, Precious-Metals