Nothing Between Oil and $40 Except Iran

By Markos N. Kaminis - Economy and Markets

By Markos N. Kaminis - Economy and MarketsVisit the front pages of Wall Street Greek and Market Moving News to see our current coverage of economic reports and financial markets.

PART I - Momentum and the Pendulum

The price of light sweet crude broke through the $60 threshold a few days ago and closed down 5% on Wednesday. There seems little stopping it breaking through $50 in short order, but there's one troublesome factor that could take it well above that level no matter.

As the global economy decomposes, and fear takes hold of all of its facets, energy demand will surely wane in the near term. The overwhelming momentum of oil price slide, driven by the unwinding of speculative investments and by panic sale, has now handed its baton over to counter-speculation and real data driven selling. The fly in the ointment, however, is notable. And while bull-side support may be solitary in quantity, it packs quite a punch. An Iranian event, which we believe is within a cat's whisker now, has the undeniable potential to help oil break quickly higher and through its all-time dollar peak. But be careful, because even within that bullish potion, there is risk of poisoning.

(Article interests: AMEX: DIA, AMEX: SPY, Nasdaq: QQQQ, NYSE: NYX, AMEX: DOG, AMEX: SDS, AMEX: QLD, AMEX: XLF, AMEX: IWM, AMEX: TWM, AMEX: IWD, AMEX: SDK)

Light sweet crude for December delivery closed $3 lower on Wednesday, to just above $56. That same momentum that took oil over $140 as recently as July, looks to now drive it to nothing! So you might consider stocking up on crude soon cowboy! The tight balance of energy supply/demand should resurface soon enough in inflated pricing. When oil moves higher again, you could be as well off as the luckiest wildcatter in Dallas.

OPEC's Futility

Gasoline hit a national average of $2.20 a gallon Wednesday, down from over $4 in July. Talk about a wild ride! Even the Arabs can't stop the runaway train. Meaningless production cuts, and threats of more to come have had no lasting effect on oil's drilling lower. What's worse for OPEC is that traders now view it powerless in affecting price. It would take a drastic action to give oil a wake up call. OPEC's growing doubt in the power of its word, in light of crude's stubborn move, could eventually keep it from acting altogether. Thursday, however, they gave it a go.

An OPEC delegate was quoted indicating a full meeting was likely this month, well ahead of the scheduled December time frame. Iran is reportedly actively pushing the organization to take action, and another production cut is a given. The question is, how willing is OPEC to make the magnitude of cut necessary to affect price now? Because only an eye catching action, one significantly greater than the IEA demand-side reduction, could stop momentum. Even that won't be enough to keep prices steady though. OPEC's greedy and cheating member states will then have to follow through with their agreed upon portions, and that's no given.

For Good Reason

Oil is not declining without reason. We are after all within the most significant recession in decades. Many fear that with a few more poor decisions here or there, we could rival the difficult times of the Great Depression.

This is a long time coming. Consumers have been living on credit for far too long, and excesses have a way of expanding until they bust. We came quite a ways before breaking, and so the fall will now be hard and heavy.

Recent years' cost of living increases have only exacerbated pressure on credit burdened consumers. The most significant cost increases have come in food and energy sectors, where technological and geographical efficiencies of production could not offset the impact of demand increase. Saddle consumers with loss of wealth in their homes and investments, and you have the makings of catastrophe. As they lose their jobs as well, bad gets worse. What comes next should drive humanity toward hysteria (keep reading).

Demand on Decline

As is to be expected, demand for energy falls off as industrial plants close or reduce hours of operation. Likewise, fuel demand decreases as less distribution resources are required and as shipping needs decline.

This week, the International Energy Agency (IEA) issued its World Energy Outlook and Oil Market Report. The IEA revised lower its demand forecast for the globe, which likewise started oil lower again until the OPEC counter statement hit the wire. The IEA cut its demand forecast by 330K B/D and 670K B/D for 2008 and 2009, respectively. It based its move on IMF downward adjustments to global GDP projections.

Pendulum Swinging Too Far?

As oil swiftly drills lower, one must wonder, have we come too far too fast? The same organization that lowered its demand forecast, warned the day before of a coming supply crunch. The IEA openly worried that the current economic crisis could renew energy complacency. Indeed, profit is the real driver behind alternative energy, as it is behind everything in our greed driven society. If oil prices had not appreciated so dramatically and to such heights, can we honestly say alternative energy options would be such acceptable solutions today. After all, it's the competitive price of oil that drives alternatives.

"stop patting yourselves on the back, because your protests in city squares couldn't hold a candle to the business model viability gained as oil prices soared."

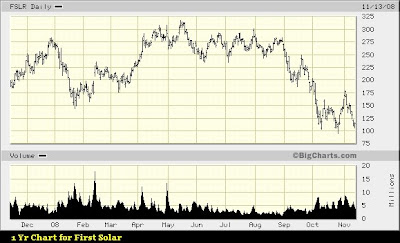

Only as it became economically feasible to employ wind and solar energy options, did the capital markets adopt alternative energy stocks with open arms. So, all you green clad folks can stop patting yourselves on the back, because your protests in city squares couldn't hold a candle to the business model viability gained as oil prices soared. And if you don't believe me, then ask yourself why the chart of this poster child of solar stocks is so horribly ugly, even as alternative energy friendly Obama sits as President Elect.

If alternative energy was attractive to us because we cared about our environment, then First Solar (Nasdaq: FSLR) would still trade at its 52-week high, not its low. The charts of JA Solar (Nasdaq: JASO), Akeena Solar (Nasdaq: AKNS), LDK Solar (NYSE: LDK), Evergreen Solar (Nasdaq: ESLR) and all the others tell the same story. And it goes beyond solar. T. Boone Pickens has lost over a billion this year in his big wind bet.

It's the competitive price of conventional energy that drives alternative energy development. That's quite unfortunate for our society, and it leaves investors in the group with a very real loss of fortune as well. But, don't fret! What "The Greek" sees coming calls for selective positioning in the right alternative energy stocks. In your search through the wreckage of green plays, take a look at viability of product and sustainability of balance sheet. We think if you pick up the energy stock that fits the bill now, you might have yourself an excellent entry point. President-Elect Obama still has his 10-year plan, even if he can only see four years of it through. If you were wondering where our authority to speak on this topic comes from, well, we did author this article at the beginning of the year: Sunset for Solar Stocks.

(See Part 2 - Pending)

Please see our disclosures at the Wall Street Greek website and author bio pages found there.

0 Comments:

Post a Comment

<< Home