Mega Millions Jackpot Winner

Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.

Buy Real Estate

Stocks, bonds, a yacht, a Lamborghini or a trip around the world... ah the options for your windfall are limitless if you have just won the humongous Mega Millions jackpot. But of all the options available for parking some dough for safe keeping and for income and growth too, I favor real estate.

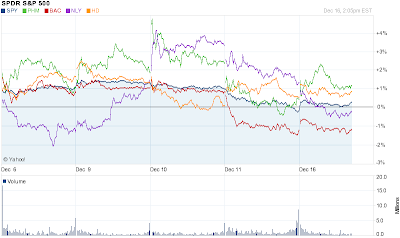

I’m a stock picker at heart, so I would buy individual stocks of course, but I would not buy the market here at the start of Fed tapering and eventually the end of easy money. Stocks will demand continued solid economic progress moving forward and interest rates are likely to increase, which means a higher cost of capital for companies. In other words, the once low-bar for economic value creation will be raised a bit. Stocks are bound to backtrack, especially given their gains this year, unless economic developments astound. Stocks have come a long way and put up awesome year-to-date performances, so profit taking won’t take much of a catalyst here.

Security

|

Year-to-Date

|

SPDR S&P 500 (NYSE: SPY)

|

+27.6%

|

SPDR Dow Jones (NYSE: DIA)

|

+23.9%

|

PowerShares QQQ (Nasdaq: QQQ)

|

+32.3%

|

When interest rates rise, bond prices are pressured. Now the Fed is doing its best to not significantly impact bond or stock values by taking it slow and making sure everybody knows it will be data driven. Still, bonds are not my cup of tea, and given the danger of itchy trigger fingers among other investors in the securities because of the dangerous rate environment, I’ll steer clear here as well.

Gold I like, and its relatives are not too bad either for a short to intermediate term taste. I’m speaking of the SPDR Gold Shares (NYSE: GLD), iShares Silver Trust (NYSE: SLV) and the MarketVectors Gold Miners (NYSE: GDX). However, I would still not buy gold now, assuming Comet ISON fragments aren’t on the way to disrupt Christmas; in that case, I would buy a lot of gold. We have to assume normalcy here I suppose, and in an environment where the Fed is cutting back on its easy money policies, however slowly, precious metals remain out of favor. That is why we have seen the decline that we have in these securities and the spot metals over recent months.

So what do you buy then? I say real estate. Sure rising interest rates threaten capital appreciation and price gains, but they also could limit the ability of others and ourselves to buy real estate in the future. I think it’s of utmost importance to have your own shelter now that it is still relatively affordable and while financing costs are still favorable. Though, given the Fed’s featherweight foot braking, mortgage rates might not spike as high as investors once feared.

The Fed does not want to disturb the recovery of the housing market, and so will monitor the situation as it tapers back asset purchases, including those of mortgage-backed securities. It’s also mindful of the economy, obviously, and so should not impede commercial real estate opportunities nor demand for residential rentals. And even if it does, I would much rather hold hard assets with the ability to reduce rent if necessary to keep them filled and earn income than hold paper money that I’m not sure will always have value.

Does that mean real estate relative stocks are also worth holding? For that derivative investment I would look first to the REITs like Education Realty Trust (NYSE: EDR) with its 5% dividend yield and 11.5% projected long-term growth; Apartment Investment & Management (NYSE: AIV) with its modest PEG ratio, good growth and 3.7% dividend; Health Care REIT (NYSE: HCN) with its focus on senior living and health care properties; and of the homebuilders, just a name like Toll Brothers (NYSE: TOL), which possesses pricing power; and Annaly Capital (NYSE: NLY), the mortgage REIT I think will benefit as the Fed slowly exits the MBA market. Obviously, Bank of America (NYSE: BAC) continues to benefit from Fed mastered Goldilocks rate and economic management. I understand the Mega Millions jackpot will be divided by two winners, but it’s still significant enough to put to serious and good use; for that, I suggest real estate.

Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Labels: INDUSTRY-REIT-Residential, Real-Estate, Real-Estate-2013-Q4