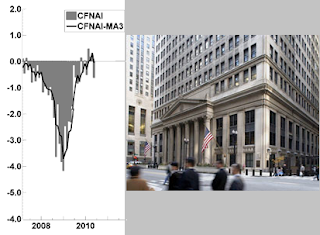

Chicago Fed National Activity Index June 2010

Chicago Fed Confirms Our Concerns

An important, though lightly followed, economic barometer dipped into the red in June, continuing the recent trend of deteriorating economic data. We have noted an underlying ugly trend in a cesspool of dull to declining national economic indicators. This latest sign from the Chicago Fed's National Activity Index only supports our concern for double-dip recession and solidifies our argument for continued economic stimulus and less fiscal budget focus.

"The Greek" earned clients a 23% average annual return over five years as a stock analyst on Wall Street. While writing for Wall Street Greek and others, he presciently predicted the financial crisis and housing and banking failures of the Great Recession. Visit the front pages of Wall Street Greek now to see our current coverage of business news, the global economy & financial markets, real estate, shipping, fine art & antiquities and global affairs.

(Tickers: NYSE: JPM, NYSE: BAC, NYSE: WFC, NYSE: TD, NYSE: PNC, NYSE: C, NYSE: MS, NYSE: GS, NYSE: AHC, Nasdaq: ADVS, NYSE: ALB, NYSE: ACV, NYSE: ACL, Nasdaq: ALXA, Nasdaq: AHGP, Nasdaq: ARLP, Nasdaq: ACGL, NYSE: AEC, Nasdaq: AWRE, NYSE: BOH, NYSE: BWP, Nasdaq: BBNK, Nasdaq: CALM, NYSE: CX, Nasdaq: CRNT, Nasdaq: CYOU, Nasdaq: CHFC, NYSE: CSR, Nasdaq: CSBC, Nasdaq: CPBC, NYSE: CR, NYSE: CTS, NYSE: DEP, Nasdaq: EGBN, Nasdaq: ENBD, NYSE: EPD, NYSE: FNB, Nasdaq: FISI, Nasdaq: FCAP, Nasdaq: FFCH, NYSE: FLR, NYSE: FTI, NYSE: FMX, AMEX: FRS, NYSE: PAC, NYSE: HMA, Nasdaq: HSTM, Nasdaq: HTLF, NYSE: HXL, Nasdaq: HFBC, Nasdaq: IDIX, NYSE: IBA, Nasdaq: INSU, Nasdaq: IDTI, Nasdaq: ININ, Nasdaq: IPCM, Nasdaq: KVHI, Nasdaq: LKFN, NYSE: LF, Nasdaq: LEGC, NYSE: LM, NYSE: LRY, Nasdaq: LOCM, NYSE: LO, NYSE: LUX, NYSE: MAS, Nasdaq: MBVT, Nasdaq: MSPD, NYSE: MRH, Nasdaq: NARA, NYSE: NMM, NYSE: NED, Nasdaq: NWBI, NYSE: ONB, NYSE: OMI, Nasdaq: PCTI, Nasdaq: PEBK, NYSE: PLT, NYSE: PCL, Nasdaq: PLXT, Nasdaq: PRGX, Nasdaq: PBNY, Nasdaq: RDCM, NYSE: RRC, NYSE: RGA, Nasdaq: RCII, NYSE: RKT, NYSE: ROP, NYSE: RPM, Nasdaq: SANM, Nasdaq: SVVS, Nasdaq: SILC, NYSE: SLG, Nasdaq: SOHU, NYSE: SOA, Nasdaq: SONO, NYSE: STL, Nasdaq: SFSF, Nasdaq: SYNL, NYSE: TRH, Nasdaq: UCTT, Nasdaq: UFCS, NYSE: UHS, Nasdaq: VECO, Nasdaq: VPFGD, Nasdaq: VLTR, NYSE: WRB, NYSE: WPP, Nasdaq: WSBC, Nasdaq: WSFS, Nasdaq: ZRAN, NYSE: DIA, NYSE: SPY, Nasdaq: QQQQ, NYSE: DOG, NYSE: SDS, NYSE: QLD)

Chicago Fed National Activity Index June 2010

An important Chicago Fed published economic barometer hit the wire on a somewhat quiet Monday morning, and oh by the way, the news was not good. The Chicago Fed's National Activity Index dipped into negative territory, marking a drab -0.63, down from May's reading of +0.31.

An important Chicago Fed published economic barometer hit the wire on a somewhat quiet Monday morning, and oh by the way, the news was not good. The Chicago Fed's National Activity Index dipped into negative territory, marking a drab -0.63, down from May's reading of +0.31.June's negative reading marks the first such instance since this past February, but it is not a random outlier. Rather, it offers further reason for serious concern, as the Chicago Fed's National Activity Index's 3-month moving average also slipped into negativity. The moving average fell to -0.05, versus May's reading of +0.31. Given this more relevant trend line, economic experts would have to reach to call this an anomaly. This is not to mention that the gurus on Wall Street would have to completely ignore the last few months of telling data. Wall Street Greek, however, is independent and unbiased by design, and therefore, has eyes to see. We are not peddling anything, nor soliciting readers' investment dollars, and based on a history of prescient forecasting, have proven essential to your investment toolbox.

The Trouble is Intensifying

The Chicago Fed reported that three of four component indexes contributed to June's drop. Thirty-six of the 85 individual indicators made positive contributions to the index in June, while 49 made negative contributions. Twenty-nine indicators improved from May to June, while 56 indicators deteriorated. Of the indicators that improved, thirteen still made negative contributions.

"The Chicago Fed's index is basically looking at a series of other economic indicators and attempting to pull the economic puzzle together."

We would expect it might be obvious to you by now that unemployment is a drag on the economy. Well, based on the Chicago Fed report, the labor situation only got worse in June. Employment-related indicators made a -0.13 contribution to the index, after having a positive 0.08 impact in May. The Chicago Fed's index is basically looking at a series of other economic indicators and attempting to pull the economic puzzle together.

Production-related indicators offered a -0.11 contribution to the index in June, after having a +0.61 impact in May. We have regularly highlighted for you the slow-down in manufacturing; finally now, the broader press is picking up on it as well. Manufacturing production played a key role in this component's demise in June, however, the pace of growth in other industrial production slowed also.

Weighing on the index in May, the Consumption and Housing category improved in June. Yes, based on the report, consumption and housing only drained the broader index by -0.43 in June, versus the -0.45 draw in May. There's no good news here. With government crutches pulled now from the housing space, and with pressure increasing for the same action to the long-term unemployed (on benefit extensions), we have been expecting a second collapse in economic activity.

The only positive contributor in June, Sales Orders & Inventories, added just 0.05 to the index, after a 0.06 addition in May. And we find little reason to be enthused by this component at all, considering the New Orders component seems to be giving way. ISM's Manufacturing New Orders Index dropped sharply in June (though while still marking economic expansion).

"The report offers some good news, if you are the type that views a lost limb better than bleeding to death. It's still painful."

The report offers some good news, if you are the type that views a lost limb better than bleeding to death. It's still painful. According to the Chicago Fed, and based on historical statistics, the moving average has to get to -0.70 for it to signify that recession is underway. At -0.05, we remain somewhat distanced from that. However, remember that the ship must slow before it stops. We again remind readers, though, that renewed recession is a mathematical unlikelihood, while troubled economic times that should prove just as difficult to traverse seem clearly probable.

Monday's corporate news drivers include earnings reports from A.H. Belo (NYSE: AHC), Advent Software (Nasdaq: ADVS), Albemarle (NYSE: ALB), Alberto Culver (NYSE: ACV), Alcon (NYSE: ACL), Alexza Pharmaceuticals (Nasdaq: ALXA), Alliance Holdings (Nasdaq: AHGP), Alliance Resource Partners (Nasdaq: ARLP), Arch Capital (Nasdaq: ACGL), Associated Estates Realty (NYSE: AEC), Aware (Nasdaq: AWRE), Bank of Hawaii (NYSE: BOH), Boardwalk Pipeline Partners (NYSE: BWP), Bridge Capital (Nasdaq: BBNK), Cal-Maine Foods (Nasdaq: CALM), CEMEX (NYSE: CX), Ceragon Networks (Nasdaq: CRNT), Changyou Com (Nasdaq: CYOU), Chemical Financial (Nasdaq: CHFC), China Security & Surveillance (NYSE: CSR), Citizens South Banking (Nasdaq: CSBC), Community Partners Bancorp (Nasdaq: CPBC), Crane (NYSE: CR), CTS Corp. (NYSE: CTS), Duncan Energy Partners (NYSE: DEP), Eagle Bancorp (Nasdaq: EGBN), Emirates NBD (Nasdaq: ENBD), Enterprise Products Partners (NYSE: EPD), FNB Corp. (NYSE: FNB), Financial Institutions (Nasdaq: FISI), First Capital (Nasdaq: FCAP), First Fin'l Holdings (Nasdaq: FFCH), Fluor (NYSE: FLR), FMC Technologies (NYSE: FTI), Fomento Economico Mexicano (NYSE: FMX), Frischs Restaurant (AMEX: FRS), Grupo Aeroportuario Del Pacifico SA (NYSE: PAC), Health Management Associates (NYSE: HMA), HealthStream (Nasdaq: HSTM), Heartland Fin'l USA (Nasdaq: HTLF), Hexcel (NYSE: HXL), Hopfed Bancorp (Nasdaq: HFBC), Idenix Pharmaceuticals (Nasdaq: IDIX), Industrias Bachoco SAB (NYSE: IBA), Insituform Technologies (Nasdaq: INSU), Integrated Device Technology (Nasdaq: IDTI), Interactive Intelligence (Nasdaq: ININ), IPC The Hospitalist (Nasdaq: IPCM), KVH Industries (Nasdaq: KVHI), Lakeland Financial (Nasdaq: LKFN), Leapfrog (NYSE: LF), Legacy Bancorp (Nasdaq: LEGC), Legg Mason (NYSE: LM), Liberty Property Trust (NYSE: LRY), Local.com (Nasdaq: LOCM), Lorillard (NYSE: LO), Luxottica (NYSE: LUX), Masco (NYSE: MAS), Merchants Bancshares (Nasdaq: MBVT), Mindspeed Technologies (Nasdaq: MSPD), Montpelier Re (NYSE: MRH), Nara Bancorp (Nasdaq: NARA), Navios Maritime Partners (NYSE: NMM), Noah Education (NYSE: NED), Northwest Bancorp (Nasdaq: NWBI), Old National Bancorp (NYSE: ONB), Owens & Minor (NYSE: OMI), PC-Tel (Nasdaq: PCTI), Peoples Bancorp of North Carolina (Nasdaq: PEBK), Plantronics (NYSE: PLT), Plum Creek Timber (NYSE: PCL), PLX Technology (Nasdaq: PLXT), PRGX Global (Nasdaq: PRGX), Provident Bancorp (Nasdaq: PBNY), Radcom (Nasdaq: RDCM), Range Resources (NYSE: RRC), Reinsurance Group of America (NYSE: RGA), Rent-A-Center (Nasdaq: RCII), Rock-Tenn (NYSE: RKT), Roper Industries (NYSE: ROP), RPM International (NYSE: RPM), Sanmina-SCI (Nasdaq: SANM), Savvis (Nasdaq: SVVS), Silicom (Nasdaq: SILC), SL Green Realty (NYSE: SLG), SOHU.com (Nasdaq: SOHU), Solutia (NYSE: SOA), SonoSite (Nasdaq: SONO), Sterling Bancorp (NYSE: STL), SuccessFactors Inc. (Nasdaq: SFSF), Synalloy (Nasdaq: SYNL), Transatlantic Holdings (NYSE: TRH), Ultra Clean Holdings (Nasdaq: UCTT), United Fire (Nasdaq: UFCS), Universal Health Services (NYSE: UHS), Veeco Instruments (Nasdaq: VECO), Viewpoint Fin'l Group (Nasdaq: VPFGD), Volterra Semiconductor (Nasdaq: VLTR), W.R. Berkley (NYSE: WRB), Wausau Paper (NYSE: WPP), Wesbanco (Nasdaq: WSBC), WSFS Financial (Nasdaq: WSFS) and Zoran (Nasdaq: ZRAN).

Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Labels: Double_Dip_Recession, Economic Reports, Economy

0 Comments:

Post a Comment

<< Home