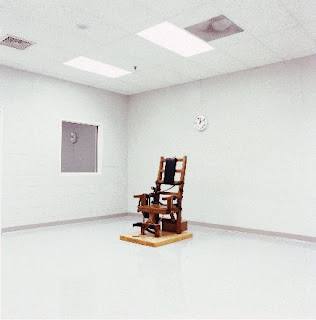

Retail Industry Death Row

Visit the front pages of Wall Street Greek and Market Moving News to see our current coverage of economic reports and financial markets.

By Markos N. Kaminis - Economy & Markets:

By Markos N. Kaminis - Economy & Markets:

If you work in retail, then you probably feel like a prisoner on death row. Any day now, your number might be called to face the electric chair, mildly known as the unemployment line. Times are tough in the now exposed as saturated store environment, and consolidation is a necessity to avoid bankruptcy. Retailers reported Chain Store Sales for the month of December today. Accompanying the reports were announcements of several internal earnings forecast reductions and cost consolidation actions, including store closures. You can expect many more reports like these as retailers close out their fiscal fourth quarter this month.

(Article interests: NYSE: KSS, Nasdaq: DLTR, AMEX: DIA, AMEX: SPY, Nasdaq: QQQQ, NYSE: NYX, AMEX: DOG, AMEX: SDS, AMEX: QLD, AMEX: XLF, AMEX: IWM, AMEX: TWM, AMEX: IWD, AMEX: SDK)

The Greek has been harping on the pending demise of retail for over a year now, if not longer. Thus, our readers may be more relieved than concerned on days like these. Sentiment turned so lousy through the second half of '08 though, that all correlations went to 1.0, and everything fell in concert. Still, I believe those who may already be looking for early cyclical ideas would still be better served refraining from the retail space now.

I recall telling a Research Director during an interview in 2006 (I think) that the pending recession would call for retail favor toward discount stores. I didn't get that job because it was still early in the cycle, and the Director didn't have the foresight to see what was coming. The space took a valuation hit early on in the downturn, but then recovered as prognosticators looked toward economic recovery too soon. The fact is that the deepest cuts in consumer spending are still ahead of us.

Without the support of guilt-inspired holiday spending, retailers are left naked out in the cold here. Therefore, the next few months will serve as harsh catalyst for corporate action. Indeed, as corporate executives eye-over December and fourth quarter operational performance, it should be plainly apparent that growth plans need reigning in and that weaker stores might be better off closed than fixed.

We have already seen the quick demise of a few players that had been operating on the fringe. Names like Linens 'n Things, Mervyn's, Talbots (NYSE: TLB) and Circuit City (NYSE: CC) closed shop over the past year or so. Tough times serve for shakeout, separating the strong from the frail. You might compare it to the Spartan custom of tossing their sickly or imperfect babes from cliff's ledge. That's what retailers face now. After some time, if the child was found clinging to life alone on the cold hillside, he was given another chance to be a Spartan. Maybe I should note here that I'm not implying you buy Spartan Stores (Nasdaq: SPTN); that is not unless it displays Spartan spirit.

As early as last year, even Macy's (NYSE: M) was closing shops, as the department store segment was the first hit. After all, who would value the convenience of a one-stop-shop over the better pricing of specialists in hard times? Only discounters like Wal-Mart (NYSE: WMT) offer both, and so it was lifted as one of a handful of retail industry stocks to appreciate in value this past year. Wal-Mart returned an astounding 20% to investors in 2008 when taking dividends into account.

The International Council of Shopping Centers just reported that December same-store sales fell 1.7% overall. The holiday season finally gave in, after years of battling. Though we now know those years were aided by illegal substance abuse(i.e. credit). Guess we'll have to mark up the record with plenty of asterisks. This holiday season was the worst in forty years, according to the ICSC. Not since 1969, have things been this bad. Trivia question: What significance has 1969 to The Greek? (comment below)

Even mighty Wal-Mart cut its forecast today after weaker than expected same-store sales (though still positive 1.7%, excluding gasoline). If people are having trouble affording even Wal-Mart, then we'll have to move to the deep discount niche for safe haven. Family Dollar (NYSE: FDO) actually posted solid results yesterday and got a thumbs up from Jim Cramer. Jim noted that FDO does well in times like these, and recently traded below its average P/E for such troubled times. People still gotta eat folks, and survive; they'll just do it cheaper now. We have to agree on the FDO call, though I also buy into the old adage, "you get what you pay for." FDO is up much over the past couple days, so you might want to take that into account when considering entry point.

Wal-Mart still fared better than its peers, as Target's (NYSE: TGT) sales fell 4.1% and Costco's (Nasdaq: COST) dipped 4%. Still, gas contributes significantly to Costco's results, and excluding that factor (gas prices declined) same-store sales actually rose. Closer inspection of the broad spectrum of retailers better illustrates the decimation.

December Same-Store Sales:

Just as I would not buy a boat while expecting a hurricane, I would not buy most retail now either. Still, if you are looking for a few names that might find last minute pardon from death row, here are a few ideas... It's clear money is piling into discount, and that could drive momentum a while longer (read Family Dollar). Target actually beat analysts' expectations in posting its December sales decline, and that may have had something to do with its recent decision to shift product toward more everyday needs like groceries. It definitely had something to do with price reduction for market share gain, and that should be apparent in softer margins come reporting time. Anyway, it's cheaper than Wal-Mart on a P/E basis, and is attempting to adjust to the climate in order to become more like Wal-Mart, so it might be worth a closer look. You might want to do a little praying too if you dare dabble in retail now.

Please see our disclosures at the Wall Street Greek website and author bio pages found there.

By Markos N. Kaminis - Economy & Markets:

By Markos N. Kaminis - Economy & Markets:If you work in retail, then you probably feel like a prisoner on death row. Any day now, your number might be called to face the electric chair, mildly known as the unemployment line. Times are tough in the now exposed as saturated store environment, and consolidation is a necessity to avoid bankruptcy. Retailers reported Chain Store Sales for the month of December today. Accompanying the reports were announcements of several internal earnings forecast reductions and cost consolidation actions, including store closures. You can expect many more reports like these as retailers close out their fiscal fourth quarter this month.

(Article interests: NYSE: KSS, Nasdaq: DLTR, AMEX: DIA, AMEX: SPY, Nasdaq: QQQQ, NYSE: NYX, AMEX: DOG, AMEX: SDS, AMEX: QLD, AMEX: XLF, AMEX: IWM, AMEX: TWM, AMEX: IWD, AMEX: SDK)

The Greek has been harping on the pending demise of retail for over a year now, if not longer. Thus, our readers may be more relieved than concerned on days like these. Sentiment turned so lousy through the second half of '08 though, that all correlations went to 1.0, and everything fell in concert. Still, I believe those who may already be looking for early cyclical ideas would still be better served refraining from the retail space now.

I recall telling a Research Director during an interview in 2006 (I think) that the pending recession would call for retail favor toward discount stores. I didn't get that job because it was still early in the cycle, and the Director didn't have the foresight to see what was coming. The space took a valuation hit early on in the downturn, but then recovered as prognosticators looked toward economic recovery too soon. The fact is that the deepest cuts in consumer spending are still ahead of us.

Without the support of guilt-inspired holiday spending, retailers are left naked out in the cold here. Therefore, the next few months will serve as harsh catalyst for corporate action. Indeed, as corporate executives eye-over December and fourth quarter operational performance, it should be plainly apparent that growth plans need reigning in and that weaker stores might be better off closed than fixed.

We have already seen the quick demise of a few players that had been operating on the fringe. Names like Linens 'n Things, Mervyn's, Talbots (NYSE: TLB) and Circuit City (NYSE: CC) closed shop over the past year or so. Tough times serve for shakeout, separating the strong from the frail. You might compare it to the Spartan custom of tossing their sickly or imperfect babes from cliff's ledge. That's what retailers face now. After some time, if the child was found clinging to life alone on the cold hillside, he was given another chance to be a Spartan. Maybe I should note here that I'm not implying you buy Spartan Stores (Nasdaq: SPTN); that is not unless it displays Spartan spirit.

As early as last year, even Macy's (NYSE: M) was closing shops, as the department store segment was the first hit. After all, who would value the convenience of a one-stop-shop over the better pricing of specialists in hard times? Only discounters like Wal-Mart (NYSE: WMT) offer both, and so it was lifted as one of a handful of retail industry stocks to appreciate in value this past year. Wal-Mart returned an astounding 20% to investors in 2008 when taking dividends into account.

The International Council of Shopping Centers just reported that December same-store sales fell 1.7% overall. The holiday season finally gave in, after years of battling. Though we now know those years were aided by illegal substance abuse(i.e. credit). Guess we'll have to mark up the record with plenty of asterisks. This holiday season was the worst in forty years, according to the ICSC. Not since 1969, have things been this bad. Trivia question: What significance has 1969 to The Greek? (comment below)

Even mighty Wal-Mart cut its forecast today after weaker than expected same-store sales (though still positive 1.7%, excluding gasoline). If people are having trouble affording even Wal-Mart, then we'll have to move to the deep discount niche for safe haven. Family Dollar (NYSE: FDO) actually posted solid results yesterday and got a thumbs up from Jim Cramer. Jim noted that FDO does well in times like these, and recently traded below its average P/E for such troubled times. People still gotta eat folks, and survive; they'll just do it cheaper now. We have to agree on the FDO call, though I also buy into the old adage, "you get what you pay for." FDO is up much over the past couple days, so you might want to take that into account when considering entry point.

Wal-Mart still fared better than its peers, as Target's (NYSE: TGT) sales fell 4.1% and Costco's (Nasdaq: COST) dipped 4%. Still, gas contributes significantly to Costco's results, and excluding that factor (gas prices declined) same-store sales actually rose. Closer inspection of the broad spectrum of retailers better illustrates the decimation.

December Same-Store Sales:

- Wal-Mart (NYSE: WMT): +1.2%

- Target (NYSE: TGT): -4.1%

- Costco (Nasdaq: COST): -4.0%

- Macy's (NYSE: M): -4.0%

- J.C. Penney (NYSE: JCP): -8.1%

- Sears (Nasdaq: SHLD): -7.3%

- Neiman Marcus: -27.5%

- Saks (NYSE: SKS): -19.8%

- Gap (NYSE: GPS): -14.0%

- Limited Brands (NYSE: LTD): -10.0%

- Abercrombie & Fitch (NYSE: ANF): -24.0%

- Wet Seal (Nasdaq: WTSLA): -12.5%

- Family Dollar (NYSE: FDO): +6.0%

Just as I would not buy a boat while expecting a hurricane, I would not buy most retail now either. Still, if you are looking for a few names that might find last minute pardon from death row, here are a few ideas... It's clear money is piling into discount, and that could drive momentum a while longer (read Family Dollar). Target actually beat analysts' expectations in posting its December sales decline, and that may have had something to do with its recent decision to shift product toward more everyday needs like groceries. It definitely had something to do with price reduction for market share gain, and that should be apparent in softer margins come reporting time. Anyway, it's cheaper than Wal-Mart on a P/E basis, and is attempting to adjust to the climate in order to become more like Wal-Mart, so it might be worth a closer look. You might want to do a little praying too if you dare dabble in retail now.

Please see our disclosures at the Wall Street Greek website and author bio pages found there.

Labels: Economic Reports, Economy, Retail Industry

0 Comments:

Post a Comment

<< Home