Jobs Data Doomsday

Visit the front pages of Wall Street Greek and Market Moving News to see our current coverage of economic reports and financial markets.

By Markos N. Kaminis - Economy & Markets:

By Markos N. Kaminis - Economy & Markets:

Today's duo of jobs reports provided dire data. ADP serves as a precursor to the Labor Department's Employment Situation Report, which is due for Friday release. The implication of ADP's news is that the job market is failing fast and furiously. Heading into today's data, economists had been forecasting a 7.0% unemployment rate, but reevaluation is clearly in process now.

(Article interests: NYSE: RHI, NYSE: MAN, NYSE: KFY, AMEX: DIA, AMEX: SPY, Nasdaq: QQQQ, NYSE: NYX, AMEX: DOG, AMEX: SDS, AMEX: QLD, AMEX: XLF, AMEX: IWM, AMEX: TWM, AMEX: IWD, AMEX: SDK)

Challenger, Gray & Christmas released its Job-Cuts Report today, which is its monthly tally of planned corporate layoffs. The news was another tough chew, with December's reading of 166,348 not much short of November's 181,671. Besides the ADP data, keeping us from celebrating the improved layoff news was the fact that December represents a unique period of the year, when any leftover human warmth of heart is supposed to prevail. The holiday season may have caused some employers to show mercy, and it certainly kept some bankers from lowering the hammer.

Banks reportedly forgave debt deadlines through the holidays, especially for retailers on the fence. The hope was that some would miraculously raise cash through inventory push. Distressed retailers, and even clearly sunken ones like Circuit City (NYSE: CC) welcomed the opportunity to unload inventory at better than liquidation prices. Though some of the 70% sales we saw on the bloodied street couldn't have been far off liquidation value.

The early part of the year offers little opportunity for revenue recovery, though sales will find every holiday, from Martin Luther King's birthday to Arbor Day. Heck, some sellers might make up holidays for the sake of creating a unique sales promotion! They had better, because otherwise I see retail taking over the lead of greatest corporate firer from 2008's champs, the financial and auto sectors.

A closer inspection of 2008, shows it was the worst for layoffs since 2003, with 1,223,993 total firings across Challenger's board. Also, while the December data seemed merciful when compared against November, it still produced 275% more layoffs than December of 2007. In fact, it was the worst such December since tracking began in 1993!

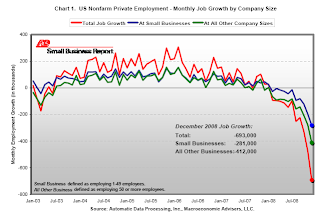

The ADP Report

Even if you're name isn't Scrooge, today's ADP Employment Report would have soured your mood. ADP declared the private sector shed a whopping 693K nonfarm payrolls in December. Adding insult to injury, the employment firm revised November's tally up to 476K jobs lost from an initially reported 250K.

As the recession began, most of the job losses were originating from large businesses, or those employing 500 people or more. In fact, jobs kept increasing for some time in the small business sector, which encompasses firms that employ 49 people or less. A clear indication that hard times have now spread, reaching every nook and cranny of American society, is that small businesses reportedly fired 281K people this past month. Since medium-sized operations managed 321K cuts, most of the month's damage came from America's backbone. Also, the service sector is now paying the most, with 473K jobs lost from the core segment of American business.

As the recession began, most of the job losses were originating from large businesses, or those employing 500 people or more. In fact, jobs kept increasing for some time in the small business sector, which encompasses firms that employ 49 people or less. A clear indication that hard times have now spread, reaching every nook and cranny of American society, is that small businesses reportedly fired 281K people this past month. Since medium-sized operations managed 321K cuts, most of the month's damage came from America's backbone. Also, the service sector is now paying the most, with 473K jobs lost from the core segment of American business.

This all sets up for a bone crushing Employment Situation Report come Friday morning. Heading into today, Bloomberg noted consensus estimates for a net 500K nonfarm payroll decline. Based on ADP's data, we could be in for a morale deflating news event, one that wakes up the bear market, as we alluded to in this week's Greek's Week Ahead. Unemployment was seen rising to 7.0%, from 6.7% before today. We venture to say both these forecasts are understated, and the market seems to agree. The Dow Jones Industrials Index, which had enjoyed hopeful trading since last Friday, turned down today.

Thursday offers two more noteworthy employment reports to further sour the mood. Monster Worldwide's (Nasdaq: MNST) Employment Index is due along with the regular weekly jobless claims data. The market should increasingly speculate on how bad Friday might be as a result. Before today, Bloomberg's group produced worst case scenario estimates of 750K for nonfarm payrolls and 7.1% for unemployment. We expect these are now creeping higher.

Please see our disclosures at the Wall Street Greek website and author bio pages found there.

By Markos N. Kaminis - Economy & Markets:

By Markos N. Kaminis - Economy & Markets:Today's duo of jobs reports provided dire data. ADP serves as a precursor to the Labor Department's Employment Situation Report, which is due for Friday release. The implication of ADP's news is that the job market is failing fast and furiously. Heading into today's data, economists had been forecasting a 7.0% unemployment rate, but reevaluation is clearly in process now.

(Article interests: NYSE: RHI, NYSE: MAN, NYSE: KFY, AMEX: DIA, AMEX: SPY, Nasdaq: QQQQ, NYSE: NYX, AMEX: DOG, AMEX: SDS, AMEX: QLD, AMEX: XLF, AMEX: IWM, AMEX: TWM, AMEX: IWD, AMEX: SDK)

Challenger, Gray & Christmas released its Job-Cuts Report today, which is its monthly tally of planned corporate layoffs. The news was another tough chew, with December's reading of 166,348 not much short of November's 181,671. Besides the ADP data, keeping us from celebrating the improved layoff news was the fact that December represents a unique period of the year, when any leftover human warmth of heart is supposed to prevail. The holiday season may have caused some employers to show mercy, and it certainly kept some bankers from lowering the hammer.

Banks reportedly forgave debt deadlines through the holidays, especially for retailers on the fence. The hope was that some would miraculously raise cash through inventory push. Distressed retailers, and even clearly sunken ones like Circuit City (NYSE: CC) welcomed the opportunity to unload inventory at better than liquidation prices. Though some of the 70% sales we saw on the bloodied street couldn't have been far off liquidation value.

The early part of the year offers little opportunity for revenue recovery, though sales will find every holiday, from Martin Luther King's birthday to Arbor Day. Heck, some sellers might make up holidays for the sake of creating a unique sales promotion! They had better, because otherwise I see retail taking over the lead of greatest corporate firer from 2008's champs, the financial and auto sectors.

A closer inspection of 2008, shows it was the worst for layoffs since 2003, with 1,223,993 total firings across Challenger's board. Also, while the December data seemed merciful when compared against November, it still produced 275% more layoffs than December of 2007. In fact, it was the worst such December since tracking began in 1993!

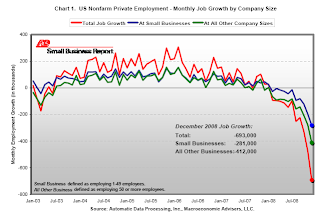

The ADP Report

Even if you're name isn't Scrooge, today's ADP Employment Report would have soured your mood. ADP declared the private sector shed a whopping 693K nonfarm payrolls in December. Adding insult to injury, the employment firm revised November's tally up to 476K jobs lost from an initially reported 250K.

As the recession began, most of the job losses were originating from large businesses, or those employing 500 people or more. In fact, jobs kept increasing for some time in the small business sector, which encompasses firms that employ 49 people or less. A clear indication that hard times have now spread, reaching every nook and cranny of American society, is that small businesses reportedly fired 281K people this past month. Since medium-sized operations managed 321K cuts, most of the month's damage came from America's backbone. Also, the service sector is now paying the most, with 473K jobs lost from the core segment of American business.

As the recession began, most of the job losses were originating from large businesses, or those employing 500 people or more. In fact, jobs kept increasing for some time in the small business sector, which encompasses firms that employ 49 people or less. A clear indication that hard times have now spread, reaching every nook and cranny of American society, is that small businesses reportedly fired 281K people this past month. Since medium-sized operations managed 321K cuts, most of the month's damage came from America's backbone. Also, the service sector is now paying the most, with 473K jobs lost from the core segment of American business.This all sets up for a bone crushing Employment Situation Report come Friday morning. Heading into today, Bloomberg noted consensus estimates for a net 500K nonfarm payroll decline. Based on ADP's data, we could be in for a morale deflating news event, one that wakes up the bear market, as we alluded to in this week's Greek's Week Ahead. Unemployment was seen rising to 7.0%, from 6.7% before today. We venture to say both these forecasts are understated, and the market seems to agree. The Dow Jones Industrials Index, which had enjoyed hopeful trading since last Friday, turned down today.

Thursday offers two more noteworthy employment reports to further sour the mood. Monster Worldwide's (Nasdaq: MNST) Employment Index is due along with the regular weekly jobless claims data. The market should increasingly speculate on how bad Friday might be as a result. Before today, Bloomberg's group produced worst case scenario estimates of 750K for nonfarm payrolls and 7.1% for unemployment. We expect these are now creeping higher.

Please see our disclosures at the Wall Street Greek website and author bio pages found there.

Labels: Economic Reports

0 Comments:

Post a Comment

<< Home