Has the Housing Market Bottomed?

By "The Greek"

By "The Greek"Investment gurus like Larry Kudlow, Jim Cramer and our own real estate guru, Michael Douville, have been pounding the table lately in predicting that the housing market has bottomed. With a slew of data released over the last couple weeks, including pending home sales, new and existing home sales, Q2 foreclosures and the S&P Case Shiller Price Index, and with the passage of the housing stimulus law, we may have enough information now to explore the possibility... so let's do so.

(Article interests AMEX: DIA, AMEX: SDS, AMEX: SPY, AMEX: DOG, AMEX: QLD, Nasdaq: QQQQ, NYSE: NYX)

Is it time or what? Some data points seem to be pointing toward stabilization, and we would expect most sector strategists to miss the turning point while caught up in the drama of the moment. So the situation seems to set up for a bottom. I, for one, would be looking for a turn, IF NOT FOR that softening economy that's still in play and the Iranian event that's becoming clearer and clearer to me.

It's not the immediate potential of Iran to run a couple hundred thousand gun-less patriots across the Iraqi boarder to incite a renewed civil war and set fire to Kuwait that scares me; nor is it the possibility of a missile or two striking critical Saudi assets (which would effectively turn off the two most important spigots and make Russia richer). What worries "The Greek" is war itself. Students of history are well aware of the surprises war often holds in store. Given that Iran has had so much time to prepare, there's all the more chance of that this time around. So, I say, if these were true-to-trend times, maybe we would bottom, but the times they are a changing.

Pending Home Sales

Pending home sales for the month of June were reported this morning, and the data supports a turn. But, it's easy to be drawn into the trap of calling out a sell or buy call when the asset recommended has moved dramatically. Conformists and contrarians, a group I've fit into more often than not, find many ears willing to listen when pricing is kicking, either on the downside or upside. Don't you remember how popular Cramer was back in the day when Crocs (Nasdaq: CROX) was flying? Did it matter to you that the shoe is probably the ugliest fashion accessory I've ever seen. When I called it a trend, did your blind eyes notice? Hey, I'm no expert on shoes though, to be fair to Jim, since I liked Heely's (Nasdaq: HLYS). I actually still believe company management could be doing a better job with that product, and I'm free to take over as CEO if the Board is listening.

The Pending Home Sales Index rose 5.3% in June, to a level of 89.0, while declining against the year ago period level of 101.4. The best news was that the increase was broad based: the South climbed 9.3%; the West rose 4.6%; the Northeast 3.4%; and the Midwest edged 1.3% higher. The National Association of Realtors Chief Economist Lawrence Yun made a good observation, stating that housing data has been vacillating within a tight range of late indicating a transitory period.

New Home Sales

New home sales were reported two Fridays ago. Running at an annual pace of 530,000 in June, sales surprised on the high side even as long-term rates rose some 30 basis points during the month. Economists had been looking for a pace of just 486,000. The June rate measured slightly short of the revised figure for May of 533K (adjusted up sharply from 499K reported initially). Though on its own the data seems inadequate to call a trend, especially in light of a still weakening broader economy, the new homes metric also seems to indicate a bottoming. If that's true, we'll have to answer another question... that being, how long do we bounce around the bottom before recovery ensues in earnest.

An interesting bit of data found in the Census Bureau's Report was that new home inventory decreased to 10.0 months, from 10.4 months in May. Looking back at April (10.3) and March (11.2), seems to further validate the claim that housing has bottomed, or at least found some footing.

What of Prices?

The new home sales price data, found within the same report, is not speaking to me though. Both median and average sales prices have moderated, and I would expect the average to come down harder than the median as higher end fluff contracts sharply towards intrinsic value. Still, I do not see the convergence that I would expect to indicate a turn to normalcy. This may be because more lower-end homes are selling at foreclosure pricing still. I would expect that when foreclosures ease, the average sales price should move more swiftly toward the median.

Clearly, we need to know a lot more about the history of these data points in order to really use them properly. We would ask the question, how close should the median and average prices be in a normal environment (feel free to comment if you know the answer). The Census Bureau's Report offers data back to 2006, but I bet we could dig up older information at the website. And older information is what's necessary, since we would have to go back a few years to find a normal housing market. For now, you should know that the average sales price for new homes in June was $298,600, down 2.6% from a year ago; the median sales price in June was $230,900, down 2.0% from $235,500. You can see the average moving more swiftly, but it's not a significant difference in my opinion.

Existing Home Sales

A couple weeks ago as well, Existing Home Sales for June were reported. The existing home sales market is currently nine times more significant than the new home market (down from about 5 and 6 times when housing was soaring). It's clearly a more important barometer due to its size. The most recent month's sales fell 2.6% from May, to an annual pace of 4.86 million. However, illustrating its size and greater stability, sales were down 15.5% from the year ago measurement, as compared to the 33.2% decline of the new home sales market. So it's clear by the change in size of the new home sales market and by the dramatic collapse of new home sales, that housing players like Hovnanian (NYSE: HOV), Lennar (NYSE: LEN) and Beazer (NYSE: BZH) are getting their just due these days, since it appears they did all they could to help the housing bubble along... including making financing more accessible to people who, as it turns out, didn't deserve it.

The National Association of Realtors indicated overall home for sale inventory increased in June (bad news that matters), to an 11.1 month's supply at the current sales pace, up from 10.8 months in May. The national existing home median sales price fell 6.1%, to $215,100 in June. The larger decrease than seen in new homes perhaps shows stubborn home owners are finally sucking it up, accepting the new realities of the market. It also likely reflects the impact of foreclosures.

Foreclosures

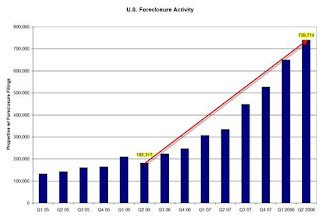

According to the NAR data, 1/3 of total sales are on foreclosed property and via short sales. It's not a surprise if you look at the chart to the right. We've now experienced eight straight quarters of foreclosure increase, and 95 out of 100 of the nation's largest metropolitan centers and 48 out of 50 states reported a year-over-year increase in the second quarter.

The large 121% increase over last year's rate, a higher jump than recent quarters, is likely the result of seasonal strength in 2007 that kept sequential foreclosures tame back then. That seasonal strength is all but dissipated now, thanks to a series of market factors. First, it's harder to buy property now, even at discounted pricing and of course also from desperate sellers who may still have equity in some instances. Those same sellers, or rather the ones without equity, often are better off not selling at a loss-- rather losing the home on loan default and walking away to rent another day; or as is now often the case, working out a deal with the bank to forgive the excess mortgage debt not repaid by the sale of the property.

Housing Stimulus Law

Congress worked up and the President signed, at the urging of his Treasury Secretary, a significant housing bill. We can thank Democratic Senator Dodd for taking the lead on this one, and the nation and Congress for rallying around it. It was well-received by the stock market as well, especially the shares of Fannie Mae (NYSE: FNM) and Freddie Mac (NYSE: FRE), which both rallied on its passage and signing into law.

The new law should help in several ways. First it creates a regulator for the GSEs, with authority to sort of watch over them and make sure they don't put their hands in the cookie jar. It also raises loan limits in high cost areas. On the surface, raising the cap to $625K seems to aid the rich, but guess what, there are plenty of poor (or close enough) people in high cost portions of the country, like New York for instance, who could use this kind of help. I know that it's hard for you folks out in Oklahoma City to imagine, because you never really saw a housing bubble, however, there were some really crappy properties in the outer boroughs of the city here going for multiples of your house plus yard. The legislation also otherwise provides liquidity to the ownership and rental housing markets. Without getting into too much detail, the law expands affordable housing to under served markets.

Some 400K homeowners are expected to benefit from the "Hope for Homeowners Act of 2008," which will allow FHA borrowers in danger of losing their homes to foreclosure, to instead refinance at significant discount to the borrower. Rather than lose their home, and deal with all the related stresses life has to offer, these borrowers will share future appreciation with the FHA. This is clearly an option worthwhile to those in danger of losing their life's investment.

First time borrowers are being extended a one-time tax credit opportunity of 10% of the value, up to $7,500, repayable over 15 years, in effect creating an interest free loan. This is expected to draw a significant number of new buyers into the market, thus stabilizing inventory or reducing it. The Chief Economist of the NAR believes this will aid pricing to stabilize, even to rise by 3-6% in 2009.

"I suspect that author has an even more complicated mind than mine, because he finds conspiracy theories within conspiracy theory!"

In Conclusion

All this bodes well, and is certainly positive stimulus to stabilize housing. However, the economy is still expected to soften further, thus pulling some away from home ownership. Finally, we would be looking toward 2009 for economic recovery in earnest, IF NOT FOR the unavoidable event risk that is Iran. And don't go quoting me from that bull-crap Barron's article on the subject that called the whole thing a bluff. I suspect that author has an even more complicated mind than mine, because he finds conspiracy theories within conspiracy theory! Combat against Iran ruins the whole party folks, and most would like to avoid discounting the possibilities tied to Iran into the value of stocks and the market. We refuse to do that here. "The Greek" views Iran as likely (and soon), and the repercussions of it, perhaps startling (and frightening). So, I suggest buying a house, but make sure it has a bunker included!

Full Disclosure: Mr. Kaminis adheres to Wall Street Greek policy and will not author articles about securities he personally owns or holds beneficial interest in. In the event of a special case, Markos would make full disclosure of ownership or beneficial interest. Wall Street Greek content does not constitute financial advice, and should not be taken as such. Please see our full disclosure at the site www.WallStreetGreek.blogspot.com.

0 Comments:

Post a Comment

<< Home