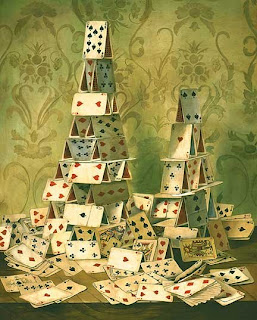

Week in Review - House of Cards

By Markos "The Greek" Kaminis

The stock market's growth from its March lows proved to be built upon a house of cards last week. Things simply fell apart. The bad news came from every direction, whether it was housing, manufacturing, inflation, geopolitical or financial sector news, most of it was unfavorable.

Housing sank deeper into the muck, contrary to what we were hoping might prove a seasonal lift. The NAHB/Wells Fargo Housing Market Index moved lower to 18, from a measure of 19 in May. Housing Starts also missed the mark, running at an annual pace of 975K, short of economists' hopes for 985K.

In the manufacturing space, industrial production fell in May, where it was expected to rise, and capacity utilization declined to 79.4%, versus expectations for 79.7%. Northeastern manufacturing is languishing right along with the Midwest. The New York area manufacturing survey showed deterioration to negative 8.7 in June, while the Philly area measure also weakened to negative 17.1.

The Producer Price Index (PPI), a widely followed metric of inflation at the producer level, jumped in May. The PPI soared 1.4% on soaring energy prices, but excluding food and energy, it was up just 0.2%. Oil prices started to moderate last week, following a route we laid out for petroleum in our article "Oil Prices and Refiner Stocks." The move was driven by favorable news flow, as Saudi Arabia indicated it would boost production, and a Kuwaiti oil minister said the natural price of crude was likely closer to $100. But then on Thursday, China announced it would hike energy prices, which was interpreted as a demand destroyer; this pulled oil significantly lower. Within our just mentioned article, however, we included a caveat that offered catalyst which could negate the entire argument, and that read, "barring an Iranian event." So, when Israel practiced for that eventuality, reported on Friday by the New York Times, oil moved back up and closed at $134.62 (crude for July delivery).

The S&P 500 smashed through that imaginary floor at 1,350, moving down 3.1% to close at 1,318. Gold moved higher on the week, and the dollar weakened to $1.56 per euro since it seems the Fed will not start hiking interest rates this week at least. Volume and trading were impacted by quadruple witching on Friday, which encompasses the expiration of four separate types of contracts at the same time, so you would expect a bit of a lift on Monday as a result.

Despite the witchcraft, the close on Friday was disconcerting. We wrote you recently, in our article "Week Ahead - Armageddon Renaissance," that a retest of the March 10 lows seemed likely once the market started digesting inflation realities. Well, guess what, 1,273 on the S&P 500 is right around the corner.

Company Specifics

Market participants got their panties all bunched up about credit again this week when Moody's downgraded the insurance arms of MBIA (NYSE: MBI) and Ambac (NYSE: ABK). Moody's (NYSE: MCO) was worried about the insurers' ability to raise capital and thus grow their businesses... you know, that little ole thing at the core of organic share rise. In case you thought S&P was sleeping again (NYSE: MHP), you were wrong this time; S&P actually cut the ratings of both firms a couple weeks ago. What's that they say though, even a blind squirrel finds a nut sometimes?

A couple old Bear Stearns (now JP Morgan NYSE: JPM) hedge fund managers got taken down by the Feds. They allegedly lied to some of their investors about mortgage market related risk, and how much of their own money they still had tied up in the fund. That fund just so happened to own a ton of mortgage-backed securities and as a result went under.

Merrill Lynch (NYSE: MER) downgraded a bunch of regional banks, while at the same time avoiding rumors that its own quarter would show poorly. Meanwhile, on the week, Goldman Sachs (NYSE: GS) reported better than expected results AGAIN. Come on now, how many psychics can one firm corner? Rivals Lehman Brothers (NYSE: LEH) and Morgan Stanley posted worse than expected results, like all well-respected investment banks are suppose to do when the financial markets are in turmoil. Take note Goldman, you're making everybody look bad...

Citigroup (NYSE: C) fell in line, when its CFO disclosed that the company would have a nice chunk of mortgage related write-downs again this quarter, and that consumer tied debt should prove problematic all year.

Ford (NYSE: F) is holding up the new F-150. Wow, it seems like just yesterday they had proudly rolled it out at the Detroit Auto Show. It looks like the Ford Verve is now clearly the word going forward.

Hey hey! Boeing (NYSE: BA) actually won its sour complaint against the Air Force, after the aerospace giant lost that huge refueling tanker contract to Northrop Grumman (NYSE: NOC) and EADS a few months back. What's this mean for BA? Well, a chance to bid again on the $35 billion dollar contract, according to recently axed Air Force boss Michael Wynne. BA's shares settled a bit Friday after an initial boost on Thursday's news.

Please see our disclosure at the Wall Street Greek website. Article also interests: AMEX: DIA, AMEX: SDS, AMEX: QLD, AMEX: DOG, AMEX: SDS, Nasdaq: QQQQ.

3 Comments:

What does this week have in store for us? Will Bernanke & Co. take inflation seriously and raise interest rates a quarter of a point? I think most of his hedge fund buddies should be done delveraging themselves...gosh, they only had 12 months to do this...at the sake of the middle class American.

Working on it Uncle, working on it. Lost my wind last night... Seems "The Greek" is human after all... Week Ahead be up shortly...

THE SUSPENSE! THE SUSPENSE....

Post a Comment

<< Home