The Federal Government Should Subsidize Public Sector Jobs

Gov't Tail Wags the Labor Market Dog

Ironically enough, after it threw money in a thousand directions in order to keep companies from firing and to inspire them to hire new employees, it was the government this month who fired the most.

Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.

Relative Tickers: NYSE: RHI, NYSE: KFY, NYSE: MAN, NYSE: MWW, Nasdaq: KELYA, Nasdaq: JOBS, NYSE: JOB, Nasdaq: CECO, Nasdaq: PAYX, NYSE: ASF, Nasdaq: KFRC, NYSE: TBI, NYSE: DHX, NYSE: SFN, NYSE: CDI, Nasdaq: CCRN, Nasdaq: ASGN, NYSE: AHS, Nasdaq: BBSI, Nasdaq: HHGP, NYSE: SRT, Nasdaq: RCMT, Nasdaq: VSCP, OTC: ASRG.OB, OTC: MCTH.OB, OTC: IGEN.OB, OTC: STJO.OB, OTC: TNUS.OB, Nasdaq: TSTF, OTC: STTH.OB, OTC: PSRU.OB, OTC: CRRS.OB, NYSE: BAC, NYSE: JPM, NYSE: GS, NYSE: C, NYSE: MS, NYSE: WFC, NYSE: TD, NYSE: PNC, NYSE: GE, NYSE: WMT, NYSE: MCD, NYSE: AA, NYSE: AXP, NYSE: BA, NYSE: CAT, Nasdaq: CSCO, NYSE: CVX, NYSE: DD, NYSE: DIS, NYSE: HD, NYSE: HPQ, NYSE: IBM, Nasdaq: INTC, NYSE: JNJ, NYSE: KFT, NYSE: KO, NYSE: MMM, NYSE: MRK, Nasdaq: MSFT, NYSE: PFE, NYSE: PG, NYSE: T, NYSE: TRV, NYSE: UTX, NYSE: VZ, NYSE: XOM, NYSE: DE, NYSE: TIF, NYSE: CO, NYSE: FRO, NYSE: DIA, NYSE: SPY, Nasdaq: QQQQ, NYSE: DOG, NYSE: SDS, NYSE: QLD, NYSE: NYX, NYSE: ICE, Nasdaq: NDAQ

The Federal Government Should Subsidize Public Sector Jobs

The latest monthly data on Announced Corporate Layoffs shows the government leading all sectors in job cuts in February. It feels like we were warning about this two years ago, and it is finally playing out in a meaningful manner, and doing its part in dragging the economy as well. We said there would be heads to roll in the ranks of the firemen, police officers, meter readers, sanitation workers, etc., and that is what is happening. As states balance budgets (because they have to), like well-publicized Wisconsin and New Jersey, the cost is born by government workers. When 2K teachers were fired in Rhode Island last week, and as Wisconsin's governor threatens similar actions, a barely growing economy faces a back-end drag as well.

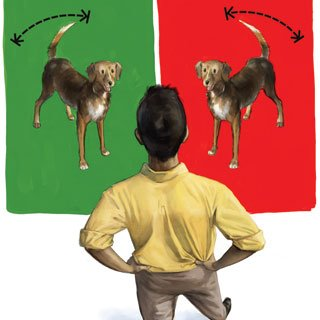

The latest monthly data on Announced Corporate Layoffs shows the government leading all sectors in job cuts in February. It feels like we were warning about this two years ago, and it is finally playing out in a meaningful manner, and doing its part in dragging the economy as well. We said there would be heads to roll in the ranks of the firemen, police officers, meter readers, sanitation workers, etc., and that is what is happening. As states balance budgets (because they have to), like well-publicized Wisconsin and New Jersey, the cost is born by government workers. When 2K teachers were fired in Rhode Island last week, and as Wisconsin's governor threatens similar actions, a barely growing economy faces a back-end drag as well.Budgets are of course tighter due to softer tax collections, the result of job losses and lax economic activity. Even while Treasury Secretary Geithner states the worst of the income declines have already been seen, it sure doesn't seem that way based on anecdotal evidence. Challenger's data shows more than anecdotal, though, thus verifying the problem. The Government and Non-Profit Sector accounted for 32% of all layoffs in February. At 16,380 announced layoffs, it was about twice the nearest sector impact, which came from Retail at 8,360. Government and Non-Profit layoffs are up an astounding 89% year-to-date against the count from 2010.

Other areas related to government spending have also played an important role in 2011 layoffs. Aerospace & Defense, for instance, is the third most important job destroyer year-to-date, with 6,286 announced layoffs, nearly twice as many as a year ago.

"I would suggest the government find a way to allocate funds to keep folks working in public jobs, rather than paying them unemployment."

You will recall that early on in the crisis, federal government money was issued to the states in order to help them cope. It would seem a good idea now to something similar. I would suggest the government find a way to allocate funds to keep folks working in public jobs, rather than paying them unemployment. When we pay unemployment, we suffer as a nation through a cycle of inefficiencies. In the first phase of unemployment, the individual tends to take a break and sort of enjoy the time off. They may or may not spend less, depending on the individual.

Jobless Joe, we'll call him, will often not look for work during this phase, and so he is shifting in mental condition as well, from an organized state to a relaxed one. After a bit, reality strikes, and the newly unemployed person will begin to worry about the money running out. At that point, Jobless Joe will start looking for work in earnest. Unfortunately, today's labor market is highly competitive, with about 15 million people unemployed across the country. Meanwhile, American companies are not hiring at a healthy pace either.

If Jobless Joe does not find a job through this phase, he progresses to a phase where he loses his skills that have been out of use for too long. He becomes unemployable, according to some labor market experts. Joe will not be pleased with the situation either, as he will have to take a pay cut and perhaps start at a much lower level position than he was used to. Thus, it makes a whole lot of sense to keep Americans working. We should consider looking into finding a way to subsidize job security in the public sector temporarily. Clearly, we need to continue to inspire economic growth for the private sector as well, as this would cure all wounds.

Article should interest investors in Paychex (Nasdaq: PAYX), Manpower (NYSE: MAN), Robert Half International (NYSE: RHI), 51Job Inc. (Nasdaq: JOBS), Monster World Wide (NYSE: MWW), Korn/Ferry International (NYSE: KFY), Administaff (NYSE: ASF), Kforce (Nasdaq: KFRC), TrueBlue (NYSE: TBI), Dice Holdings (NYSE: DHX), Kelly Services (Nasdaq: KELYA), SFN Group (NYSE: SFN), CDI Corp. (NYSE: CDI), Cross Country Healthcare (Nasdaq: CCRN), On Assignment (Nasdaq: ASGN), AMN Healthcare Services (NYSE: AHS), Barrett Business Services (Nasdaq: BBSI), Hudson Highland Group (Nasdaq: HHGP), StarTek (NYSE: SRT), RCM Technologies (Nasdaq: RCMT), VirtualScopics (Nasdaq: VSCP), American Surgical (OTC: ASRG.OB), Medical Connections (OTC: MCTH.OB), iGen Networks (OTC: IGEN.OB), St. Joseph (OTC: STJO.OB), General Employment Enterprises (NYSE: JOB), Total Neutraceutical (OTC: TNUS.OB), TeamStaff (Nasdaq: TSTF), Stratum (OTC: STTH.OB), Purespectrum (OTC: PSRU.OB), Corporate Resource Services (OTC: CRRS.OB), Bank of America (NYSE: BAC), J.P. Morgan Chase (NYSE: JPM), Goldman Sachs (NYSE: GS), Citigroup (NYSE: C), Morgan Stanley (NYSE: MS), Wells Fargo (NYSE: WFC), TD Bank (NYSE: TD), PNC Bank (NYSE: PNC), General Electric (NYSE: GE), Wal-Mart (NYSE: WMT), McDonald's (NYSE: MCD), Alcoa (NYSE: AA), American Express (NYSE: AXP), Boeing (NYSE: BA), Caterpillar (NYSE: CAT), Cisco Systems (Nasdaq: CSCO), Chevron (NYSE: CVX), DuPont (NYSE: DD), Walt Disney (NYSE: DIS), Home Depot (NYSE: HD), Hewlett-Packard (NYSE: HPQ), IBM (NYSE: IBM), Intel (Nasdaq: INTC), Johnson & Johnson (NYSE: JNJ), Kraft (NYSE: KFT), Coca-Cola (NYSE: KO), 3M (NYSE: MMM), Merck (NYSE: MRK), Microsoft (Nasdaq: MSFT), Pfizer (NYSE: PFE), Procter & Gamble (NYSE: PG), AT&T (NYSE: T), Travelers (NYSE: TRV), United Technologies (NYSE: UTX), Verizon (NYSE: VZ), Exxon Mobil (NYSE: XOM). The day’s earnings included Deere (NYSE: DE), Tiffany (NYSE: TIF), China Cord Blood (NYSE: CO) and Frontline (NYSE: FRO).

Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Labels: Economy, Editors_Picks, Labor Market

6 Comments:

Federal and state governements could cut half their work force and none of us would notice

The way out of this crisis was simple: take all of the stimulus money, divide it up per household, and offer a one-time payment of $50,000 to each family

By mandate, this money would go first to debt repayment.

Trickle down economics no longer works in this oligarchy. A cash payment would have

Yea.. welll... I'm not Jobless Joe... I'm Jobless John!

Through no real fault of my own (I tried being honest... maybe that is my fault) but I was burned by a Bank back in 92 thru 2005. Credit Rating so bad I couldn't get hired anyplace. So it's been since 98 that I've been unemployed. Kinda uniquely qualified you might say. My last position was Senior Networking Consultant for the State of Ohio and I'm certified, ex-licensed and have flourished in another half a dozen professions too. Had a plot of land in Suburbia, so I was forced, through poverty, out here into an old work shed, starting dumpster diving for parts during the building boom and constructed the house I'm in now. Forced to live off a generator and cheap solar panels, free food pantries. Makes it really hard to approach the opposite sex... "HI, I haven't been able to find a job in 14 years... but me a drink?" No refrigeration... winters no problem except the wild animals and everything freezes. I heat with wood I cut from my own backyard and burn in a stove I welded together myself. No hot water in the winter but I made a copper tubing grid that I put on the roof for the summer... solar water heater.

Govt. assistance is a bad joke. Had to forget that years ago. I grow what I can afford to grow. I pray for warm and not raining weather so I can wash my clothes. I stay home... at over $3 a gallon for gas... it's to expensive to go anywhere. I do all my own repairs.. house, car, legal work... all of it. What I've found is that those who advertise for free are either overwhelmed or lying about their true intentions.

Reading a lot helps, talking to the dog helps.... I have cats I use for the garbage disposal. I like cats and I live in the burbs... no city sewer services so this is the old fashioned way. I use kerosene lanterns, solar lanterns & candles for lighting.

I got news for ya all... after it's all gone... after you've exhausted all of your resources... wiped out your savings, your 401k's are gone, you've sold off all your "stuff", you're still gonna need "stuff" JUST to survive. Think about it now! Because the "then I'll just go ahead and die" thing... it's not a reality. I know... I came out here to die.

I haven't lived in "your world" for many years and I see the way you're heading... and it ain't good.

Steve,

Wow! Is that what it adds up to now, $50K per household? Yeah, that would have done a lot of people well enough. The debt would be gone and they would be ready to spend again. Economic drag would be gone.

John,

That is fking awesome! I can relate more than you might expect, though I haven't gotten as far as you yet. Though I believe now and trust in simple living. There are so many things we do not really need. For instance, I bet many people don't even realize anymore that television is free.

You didn't mention God John. Why? How's God fit in to your life?

Any state that lives within its means should subsidize those that don't!

Anonymous,

While you're being sarcastic, I think that as far as jobs are concerned, it is a good idea to find a way to keep people employed. The easiest way for a state to cut expenses is to fire teachers and rehire them at lower wages or after the off-season passes. To fire older cops and hire young ones, etc. We need to keep Americans working though. I say find a way to keep them working, and hold states up to cutting the equal sum from other areas.

Post a Comment

<< Home