Estate Tax Logic

On the eve of the revival of the estate tax, proposed by the President to be set at 35% in 2010, up sharply from the tax free status that the friends of the freshly perished enjoyed this year (though well off the 55% rate that robbed riches before the recent temporary freeze), we thought we might explore an aspect of the estate tax that has remained relatively undiscussed in the popular press – Estate Tax Logic.

Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.

(Relevant Tickers: NYSE: JTX, Nasdaq: INTU, NYSE: HRB, NYSE: BAC, NYSE: GS, NYSE: AIG, NYSE: WFC, NYSE: MS, NYSE: C, NYSE: DB, NYSE: CS, NYSE: UBS, NYSE: MCG, NYSE: MCO, NYSE: TD, NYSE: PNC, NYSE: STD, AMEX: GLE, NYSE: BCS, NYSE: GLD, NYSE: XLE, NYSE: XLF, NYSE: DIA, NYSE: SPY, Nasdaq: QQQQ, NYSE: DOG, NYSE: SDS, NYSE: QLD, NYSE: NYX, Nasdaq: NDAQ, NYSE: ICE, Nasdaq: SERAX, Nasdaq: SERBX, Nasdaq: SERCX, Nasdaq: SERNX, Nasdaq: FEUFX, Nasdaq: FEEEX, Nasdaq: FAEAX, Nasdaq: FBEAX, Nasdaq: FIEUX, Nasdaq: FECAX, Nasdaq: IERAX, Nasdaq: XRNEX, Nasdaq: PBEUX, Nasdaq: UEPIX, Nasdaq: UEPSX, Nasdaq: PEUGX, Nasdaq: RYAEX, NYSE: CEE, NYSE: RNE, NYSE: PEF, NYSE: GUR, NYSE: EPV, NYSE: VEA, NYSE: DFE, NYSE: DEB, NYSE: IEV, Nasdaq: ANEFX, Nasdaq: CNGAX, Nasdaq: HNEAX, NYSE: BJV, NYSE: SZI, NYSE: BPD, NYSE: IEL, NYSE: PBN, NYSE: CGW, NYSE: LVL, NYSE: FRI, NYSE: PBP, NYSE: RSU, NYSE: RMM, NYSE: REA, NYSE: RFL, NYSE: RHM, NYSE: RTG, NYSE: RSW, NYSE: RMS, NYSE: REC, Nasdaq: PDOWX, Nasdaq: XDPOX, Nasdaq: XDPDX, Nasdaq: NDUAX, Nasdaq: NDUBX, Nasdaq: IDJAX, Nasdaq: NJCRX, Nasdaq: UDPIX, Nasdaq: UDPSX, Nasdaq: UWPIX, Nasdaq: RYLDX, Nasdaq: RYIDX, Nasdaq: RYCWX, Nasdaq: ONEQ, Nasdaq: QCLN, Nasdaq: QQEW, Nasdaq: QQXT, Nasdaq: QTEC, Nasdaq: NASDX, Nasdaq: NDXKX, Nasdaq: POTCX, Nasdaq: DXQSX, Nasdaq: DXQLX, Nasdaq: FNCMX, Nasdaq: INQAX, Nasdaq: MOTAX, Nasdaq: XQQQX)

Estate Tax Logic

The divide with regard to the estate tax is clear. The rich, who are burdened by it stand mostly against it, barring a few uber wealthy emperors without heirs, or with disowned pesks. The less fortunate among us stand of course for the estate tax and the redistribution of wealth that it drives. However, logically speaking, we suggest both groups and those in between should view the subject similarly, as an unfair duplicate taxation and a means for government to add to its coffers. That said, perhaps it is a necessary evil when taken in moderation.

The divide with regard to the estate tax is clear. The rich, who are burdened by it stand mostly against it, barring a few uber wealthy emperors without heirs, or with disowned pesks. The less fortunate among us stand of course for the estate tax and the redistribution of wealth that it drives. However, logically speaking, we suggest both groups and those in between should view the subject similarly, as an unfair duplicate taxation and a means for government to add to its coffers. That said, perhaps it is a necessary evil when taken in moderation.The factors that have allowed for the estate tax are complex, and only through the understanding of them can one justify the law at all. After all, we are taxed all of our lives on our income and on our purchases, and also on some of our assets, especially real estate. Therefore, taxing the paper that survived through the shredder of government construct upon the tragic death of its creator is paradoxical. This is especially true when the beneficiary is a close blood relative or group of relatives.

We might agree that the distribution of the wealth should be counted as taxable income for an unrelated party beneficiary, but old world rules and customs dictate that family legacy is earned reward (or burden), and oftentimes the sole purpose of the wealth creator. Is it not the goal of most to make the lives of our children an easier go than our own? Thus, to tax such wealth distribution at a 55% rate seems criminal from that perspective. I would go so far as to say we are robbing history when we tax it at such a rate. So why and how does it occur then?

You might think that the wealthy minority is simply overrun by the greater citizen representation that resides below the class line. However, if we stopped our thought so prematurely we would be neglecting the power of the pools of wealth lobbying for the interests of the industrial slaves to the affluent. Wall Street and other penny counters across the globe have a lot of pull in Washington, despite the small numbers of the elite, and so they act as important advocate. After all, they earn a percentage of that pot of gold when they represent it as agent. So then if the power of money has a strong say, then why does estate taxation occur?

Well, contrary to popular belief, every once in a while a few fortunate folks decide they have enough money. Not every rich man seeks to enter the race to richest. If a heart or two still exists then on the diamond studded hills of gated communities and island mansions, we can see why there is often a willingness among the rich, or even a need, to give back. Warren Buffet, as he often has in his life, provides yet another model to follow here as well. In 2006, Mr. Buffet, then the world's richest man, pledged to give the Gates Foundation, founded by Bill Gates and his wife, shares of stock worth approximately $30 billion dollars at the time – that's billion with a B.

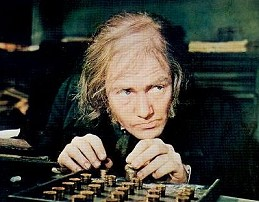

One of the positive results of estate taxes is the push it gives to philanthropy. Now I'm not saying rich people wouldn't give to charity otherwise, but I am relatively confident they would give a whole lot less without the tax benefits of gift giving. You see wealthy people tend to detest the government taking their money and putting it to bad use, or perhaps into corrupt pockets. So instead, cancer research, overseas orphanages, and homeless shelters find ample flows of capital. Looking at the tax from this perspective makes it a bit more palatable, wouldn't you say? Not every Scrooge has the fortune of midnight hour visits from the ghosts of Christmas Past, Present and Future, so perhaps many curmudgeons have the tax man instead to thank for their detour to heaven.

Thus, in the end we see that a major issue of debate is not as black and white as it seems to the various parties of argument. Once again, like so many times before, the answer is somewhere in the middle, where it grays from the influence of both sides. President Obama's working plan with the Republicans is scheduled to bring the estate tax back next year at a 35% maximum rate, versus the 55% level that tore at the hearts of wealthy families in the past. The middle-rich, or those with wealth tied to a single asset like real estate (or farm) will like that the threshold for exemption to estate taxes is planned to increase to $5 million, up from $1 million. In the past, a Manhattan brownstone owner with property worth a hypothetical $5 million, whose mother passed on, might have had to sell his property in 9 months time (distressed sale) just to pay the estate taxes. Thank you Mr. President for considering the gray matter and thinking outside the box, thereby finding a way for all of us. Thank democracy as well.

A close friend of mine, Staz Tsiavos, a guy with a heart about as big as his bear hugs, has arranged for an estate planning seminar this evening (and TBA in January) at 7:00 PM at Kellari Parea at 36 East 20th Street in New York City. He tells me dinner will be served, and you might attend if you have a net worth of a measly $4 million or so; because that's about the point of wealth where you will benefit from the insights of the professor and lawyer invited to speak on the subject. You will want to find the private room downstairs or ask for the event at the door. Staz should be reached first for RSVP purposes, or to answer other estate and retirement questions, at 917-815-0416.

Article should interest investors in: H&R Block (NYSE: HRB), Intuit (Nasdaq: INTU), Jackson Hewitt Tax Services (NYSE: JTX), NYSE: DIA, NYSE: SPY, Nasdaq: QQQQ, NYSE: DOG, NYSE: SDS, NYSE: QLD, NYSE: NYX, Nasdaq: NDAQ, NYSE: ICE, Nasdaq: SERAX, Nasdaq: SERBX, Nasdaq: SERCX, Nasdaq: SERNX, Nasdaq: FEUFX, Nasdaq: FEEEX, Nasdaq: FAEAX, Nasdaq: FBEAX, Nasdaq: FIEUX, Nasdaq: FECAX, Nasdaq: IERAX, Nasdaq: XRNEX, Nasdaq: PBEUX, Nasdaq: UEPIX, Nasdaq: UEPSX, Nasdaq: PEUGX, Nasdaq: RYAEX, NYSE: CEE, NYSE: RNE, NYSE: PEF, NYSE: GUR, NYSE: EPV, NYSE: VEA, NYSE: DFE, NYSE: DEB, NYSE: IEV, Nasdaq: ANEFX, Nasdaq: CNGAX, Nasdaq: HNEAX, NYSE: BAC, NYSE: GS, NYSE: AIG, NYSE: WFC, NYSE: MS, NYSE: C, NYSE: DB, NYSE: CS, NYSE: UBS, NYSE: MCG, NYSE: MCO, NYSE: TD, NYSE: PNC, NYSE: STD, AMEX: GLE, NYSE: BCS, NYSE: GLD, NYSE: XLE, NYSE: XLF, NYSE: BJV, NYSE: SZI, NYSE: BPD, NYSE: IEL, NYSE: PBN, NYSE: CGW, NYSE: LVL, NYSE: FRI, NYSE: PBP, NYSE: RSU, NYSE: RMM, NYSE: REA, NYSE: RFL, NYSE: RHM, NYSE: RTG, NYSE: RSW, NYSE: RMS, NYSE: REC, Nasdaq: PDOWX, Nasdaq: XDPOX, Nasdaq: XDPDX, Nasdaq: NDUAX, Nasdaq: NDUBX, Nasdaq: IDJAX, Nasdaq: NJCRX, Nasdaq: UDPIX, Nasdaq: UDPSX, Nasdaq: UWPIX, Nasdaq: RYLDX, Nasdaq: RYIDX, Nasdaq: RYCWX, Nasdaq: ONEQ, Nasdaq: QCLN, Nasdaq: QQEW, Nasdaq: QQXT, Nasdaq: QTEC, Nasdaq: NASDX, Nasdaq: NDXKX, Nasdaq: POTCX, Nasdaq: DXQSX, Nasdaq: DXQLX, Nasdaq: FNCMX, Nasdaq: INQAX, Nasdaq: MOTAX, Nasdaq: XQQQX.

Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Labels: Editors_Picks, Politics, Taxes

2 Comments:

Greek,

I'll second your support for the balance that was struck with the estate tax. Your thinking is clear, lucid and original. The only think missing, perhaps, is an indexing of the $5M untaxed base. When the inflation hits, we'll all be millionaires soon.

However, why in the heck, in the last sentence, do you thank the President - and only the President - for considering the gray matter? It seems to me that the senior Republicans deserve equal thanks. Once again, when it comes to Obama, you seem to shill for him a little bit too much, wouldn't you agree?

Yes, you are right. It's only because of democracy, which I also thanked, that we have consideration of the "gray matter."

Personally, I believe the GOP would not have kept America's unemployed hanging, but the President comes out as the good guy this way. His people-first politics might ensure him the presidency, though with an opposing legislature.

Post a Comment

<< Home