China - Iran and Fair Trade

China looks to be the next hurdle on Obama's busy schedule

"The Greek" earned clients a 23% average annual return over five years as a stock analyst on Wall Street. While writing for Wall Street Greek and others, he presciently predicted the financial crisis and housing and banking failures of the Great Recession. Visit the front pages of Wall Street Greek now to see our current coverage of business news, global financial markets, real estate, shipping, fine art, technical analysis and global affairs.

(Tickers: Nasdaq: ASIA, Nasdaq: PRASX, AMEX: PUA, AMEX: NWD, Nasdaq: MEAFX, Nasdaq: EBASX, Nasdaq: EVASX, Nasdaq: MACSX, Nasdaq: MATFX, AMEX: CZJ, Nasdaq: CHINA, PCX: FXI, PCX: CYB, AMEX: IWM, AMEX: TWM, AMEX: IWD, AMEX: SDK, NYSE: DIA, NYSE: SPY, Nasdaq: QQQQ, NYSE: DOG, NYSE: SDS, NYSE: QLD)

The market moved decidedly lower to start the week, largely on China centered concerns. The China threat is no surprise to "Greek" readers though, as we have been warning about this pending trouble for some time now. Earlier this year, we relayed these thoughts, and in our article entitled "Obama's Financial Regulation...", we even wrote:

The market moved decidedly lower to start the week, largely on China centered concerns. The China threat is no surprise to "Greek" readers though, as we have been warning about this pending trouble for some time now. Earlier this year, we relayed these thoughts, and in our article entitled "Obama's Financial Regulation...", we even wrote:"We suggest you take your profits NOW, because this has trouble written all over it; and IF the bill can pass OR if the Administration takes on China next, read that as "big trouble."

China - Iran and Fair Trade

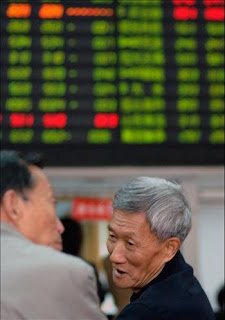

China is all the rage today, with a barrage of ominous news battering the wire all morning. Leading the fray, Chinese premier, Wen Jiabao, rebutted chatter calling for China to allow its currency to appreciate to its natural valuation, which is estimated some 20-40% higher than its current mark against the dollar. Wen argued for the yuan's current state, while also warning trading partners to mind their own business. However, that's exactly what America, the U.K. and Europe are doing, as an undervalued renminbi unnaturally boosts China's trade surplus, and unfairly burdens these other struggling economies.

Addressing this, Paul Krugman posted an article in the New York Times calling on the US Treasury to stop pretending China is not manipulating its currency, and for the US government to impose a 25% import tax on Chinese goods. The professor suggests this will force China to play fairly, similarly to how a '70s tariff forced Germany and Japan in line. He says that while he does not make such statements lightly, that the fear tied to our debt burden with China is largely misunderstood. Krugman says that it is the US which has China over a barrel, not visa-versa. This, he notes, is due to our ability to buyback our own debt, which I'm not so sure about. However, we agree that China would not want to drive a deep dive in the dollar, but perhaps this is the reason why it is slowly selling off its dollar interests.

Wen stated that nations should not take to finger-pointing and imposing taxes for the sake of currency manipulation, which is of course akin to the pot calling the kettle black. The Treasury is set to next report on trade on April 15, and considering the rhetoric coming out of Washington, we wonder if a change in tone is on its way. I think it was just last year that the fresh Treasury Secretary accidentally let it slip that indeed China was manipulating its currency. There's culpability in such statements, since the Treasury is governed by law to make honest report to the US Congress on the unfair dealings of foreign nations. However, the US government walks on eggshells when dealing with the Chinese (historically), and so Geithner took back the truth.

We wonder if old policy standards focused on careful interaction are exactly on target though, as the Chinese behave in a unique and confident manner, whether it be due to the communists' closed nation status or China's sense of reckonability. In any event, we think the present time frame is precisely the wrong one for confrontation with China. We have a need now for Chinese support with regard to Iran. When I say support, I mean we want them to at least not oppose us. But, the two simultaneous diplomatic problems may offer an opportunity.

Iran represents China's third most important oil source, and a bastion for it in a mostly Western driven oil region. Iran, in turn, understands its desperate need for a global super power in its corner, and woos increased Chinese investment. The more Chinese investment and resource interests Iran can establish within its territorial borders, improves its ability to make China see Iran's interests as its own interests. Mission accomplished? China has just become Iran's most important trade partner, with $21.2 billion in bilateral trade in 2009. However, Iran should be careful for what it wishes, because it might just get it, meaning Chinese interest intensity that leads to control of its borders.

Whether China supports Iran directly or not in the end is unknown if not unlikely, but its somewhat indirect support is seen clearly in indisputable conventional arms sales. Iran is China's second most important buyer of conventional weapons, accounting for 14% of China's arms exports over the past five years. So China has more than one reason to keep its trading partner out of harm's way.

In the end, Iran may end up a bargaining chip for China to keep the trade situation at status quo. Western states are doing their best to encourage more Middle Eastern oil states to send the commodity China's way; lessening China's dependence on Iranian oil. However, depending on the foot stepping of diplomacy, China may end up adopting an even more stubborn position on the side of Iranian interests. Should China's trading partners threaten its greedy imbalance, who could really say how far China might extend itself for the sake of its Persian partner. So Obama Administration beware, as there's plenty of time to deal with fair trade, and little time to deal with Iran.

We can be thankful that it is partly in China's interests now to allow its currency to strengthen a bit to cool inflation, something that matters much toward its burgeoning domestic consumption. There is a bubble building in its real estate, securities markets and beyond. China's inflation rate accelerated in February. Consumer prices were tracked up 2.7%, but the government attributed it to higher food prices, the result of bad weather. If February does not prove an anomaly though, we might just catch a break as China finds need to allow its currency to appreciate.

Thus, I would advise trading fair trade in for China's position on Iran. We need not engage in rhetoric and tension building with our most important trading partner of the future. What we need to do is what Iran is doing, engage China in partnerships and global interests. And we need to attend to the global build up in weapons that will otherwise fill a powder keg for the next world war.

The day's earnings reports include news from 3Com (Nasdaq: COMS), A.P. Pharma (Nasdaq: APPA), AAON Inc. (Nasdaq: AAON), Advanced Battery Technologies (Nasdaq: ABAT), Alloy, Inc. (Nasdaq: ALOY), American Apparel (NYSE: APP), American Electric Technologies (Nasdaq: AETI), American Independence (Nasdaq: AMIC), American Oil & Gas (AMEX: AEZ), American Oriental Bioengineering (NYSE: AOB), ArthroCare (Nasdaq: ARTC), AspenBio Pharma (Nasdaq: APPY), Athenahealth (Nasdaq: ATHN), ATS Corporation (Nasdaq: ATSC), Avalon Holdings (AMEX: AWX), Ballantyne Strong (AMEX: BTN), Beacon Power (Nasdaq: BCON), BioDelivery Sciences (Nasdaq: BDSI), Bionovo (Nasdaq: BNVI), Biosante Pharmaceuticals (Nasdaq: BPAX), Bitstream (Nasdaq: BITS), Blonder Tongue Laboratories (AMEX: BDR), Blue Dolphin Energy (Nasdaq: BDCO), BMP Sunstone (Nasdaq: BJGP), Bovie Medical (AMEX: BVX), BPZ Resources (NYSE: BPZ), Cadence Pharmaceuticals (Nasdaq: CADX), Capital Gold (AMEX: CGC), Care Investment Trust (AMEX: CRE), Cascade Bancorp (Nasdaq: CACB), Central Federal (Nasdaq: CFBK), Central Vermont Public Service (NYSE: CV), Century Casinos (Nasdaq: CNTY), China Housing and Land Development (Nasdaq: CHLN), China TechFaith Wireless (Nasdaq: CNTF), Clark Holdings (NYSE: GLA), CombinatoRx (Nasdaq: CRXX), Cosi Inc. (Nasdaq: COSI), Cycle Country Accessories (AMEX: ATC), CytRx (Nasdaq: CYTR), Dominion Resources (NYSE: DOM), Dune Energy (AMEX: DNE), Ecology and Environment (Nasdaq: EEI), Emeritus (NYSE: ESC), Environmental Power (Nasdaq: EPG), First Citizens Banc (Nasdaq: FCZA), First M & F Corporation (Nasdaq: FMFC), Gastar Exploration (AMEX: GST), GeoGlobal Resources (AMEX: GGR), Geokinetics (AMEX: GOK), GeoMet, Inc. (Nasdaq: GMET), Global Options (Nasdaq: GLOI), Global Sources (Nasdaq: GSOL), Gold Reserve (AMEX: GRZ), Gramercy Capital (NYSE: GKK), Granite City Food & Brewery (Nasdaq: GCFB), Gray Television (NYSE: GTN), GTx, Inc. (Nasdaq: GTXI), HealthMarkets (NYSE: UCI), Hemispherx BioPharma (AMEX: HEB), Houston Wire & Cable (Nasdaq: HWCC), HQ Sustainable Maritime (AMEX: HQS), IFM Investments Limited America (NYSE: CTC), Impac Mortgage Holdings (Nasdaq: IMPM), Insmed (Nasdaq: INSM), INX, Inc. (Nasdaq: INXI), J. Alexander's (Nasdaq: JAX), Jinpan (Nasdaq: JST), Keryx Biopharmaceuticals (Nasdaq: KERX), Kohlberg Capital (Nasdaq: KCAP), Ladenburg Thalmann (AMEX: LTS), LookSmart (Nasdaq: LOOK), Maine & Maritimes (AMEX: MAM), Medivation (Nasdaq: MDVN), MEMSIC (Nasdaq: MEMS), Meridian Resource (NYSE: TMR), Michael Baker (AMEX: BKR), MIND CTI (Nasdaq: MNDO), NexMed (Nasdaq: NEXM), Nortech Systems (Nasdaq: NSYS), Northwest Pipe (Nasdaq: NWPX), Ohio Legacy (Nasdaq: OLCB), OMNI Energy (Nasdaq: OMNI), ORBCOMM (Nasdaq: ORBC), Ore Pharmaceuticals (Nasdaq: ORXE), Parkervision, Inc. (Nasdaq: PRKR), Pharmathene (AMEX: PIP), Plug Power (Nasdaq: PLUG), Progenics (Nasdaq: PGNX), Quantum Fuel Systems (Nasdaq: QTWW), RADNET (Nasdaq: RDNT), Raser Technologies (NYSE: RZ), Reis, Inc. (Nasdaq: REIS), Retail Ventures (NYSE: RVI), Rexahn Pharmaceuticals (AMEX: RNN), Schawk, Inc. (NYSE: SGK), SCOLR Pharma (AMEX: DDD), Seaspan (NYSE: SSW), Sequenom (Nasdaq: SQNM), SpeedUs.com (Nasdaq: SPDE), Sterling Construction (Nasdaq: STRL), StoneMor Partners (Nasdaq: STON), Sucampo Pharmaceuticals (Nasdaq: SCMP), Tengasco (AMEX: TGC), TerreStar (Nasdaq: TSTR), THE9 LTD (Nasdaq: NCTY), TheStreet.com (Nasdaq: TSCM), Ticketmaster (Nasdaq: TKTM), Toreador Resources (Nasdaq: TRGL), Trimeris (Nasdaq: TRMS), Trubion Pharmaceuticals (Nasdaq: TRBN), United Western Bancorp (Nasdaq: UWBK), Universal Display (Nasdaq: PANL), Wimm-Bill-Dann Foods (NYSE: WBD), Xerium Technologies (NYSE: XRM) and ZAGG (Nasdaq: ZAGG).

Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Labels: International_Markets

0 Comments:

Post a Comment

<< Home