Housing Starts Stall - The Tail Wags the Dog

By Markos Kaminis - Economy and Financial Markets

Wall Street Greek and Market Moving News cover all economic reports and financial markets daily. Please visit the sites' front pages to see current data and analysis.

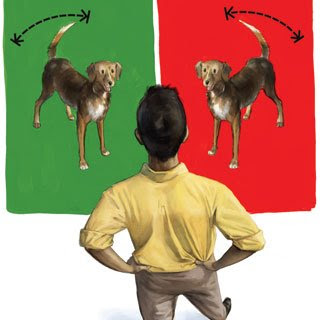

Studies show that the bias of a dog's wagging tail, to the left or to the right, offers insight into how the dog feels about you. If he views you with caution or as a potential threat, his tail favors the left side. If he sees you as a friend or nonthreatening, his tail is likely to wag to the right. The analogy that I draw to housing now, is that the dog thinks and his tail wags, and his tail wags and he acts. The housing bubble busted, sent the economy into recession, and is now experiencing the impact of recession, which is further decline.

(Article interests: NYSE: TOL, NYSE: HOV, NYSE: LEN, NYSE: DHI, Nasdaq: FSHOX, NYSE: PHM, NYSE: KBH, AMEX: XHB, Nasdaq: CHCI, NYSE: ITB, NYSE: MHO, AMEX: DIA, AMEX: SPY, Nasdaq: QQQQ, NYSE: NYX, AMEX: DOG, AMEX: SDS, AMEX: QLD, AMEX: XLF, AMEX: IWM, AMEX: TWM, AMEX: IWD, AMEX: SDK)

Housing Starts stalled in September, dropping to a level that has not been reached since the early '90s. The annual pace of housing starts ran at 817K in September, which ranked it far below consensus expectations at 880K. Permits ran even lower, at a pace of 786K; that marked the lowest point since 1981!

Housing Starts were running at a pace of 872K in August (revised) and as high as 1.012 million in January. More recently, data seemed to be flattening out, offering strategists a trap to forecast an early bottom for the industry. Because housing led this recession, many economists overlooked the fact that the consumption restraint of recession would also drive further decline in housing demand. So, we seem due (or within) another leg lower.

Housing Market Index

If you were caught off guard today, you have nobody to blame but yourself. Yesterday's release of the Housing Market Index showed that home builder sentiment is lousy now. Soft September starts capped by financial market turmoil and wealth destruction is just the right recipe to spoil home builder sentiment. The Housing Market Index, produced by the National Association of Home Builders, fell to a level of 14 in October, down from 18 in September. What's worse is that the current level of 14 marks the low point for the year, so housing looks its bleakest now.

Curious George, err Robert and Bruce Toll?

Housing stocks reacted in turn, with shares of K.B. Home (NYSE: KBH), Lennar (NYSE: LEN) and Pulte (NYSE: PHM) down 2-4%. Curiously though, Toll Brothers (NYSE: TOL) and Hovnanian (NYSE: HOV) have moved into positive territory after opening gap-down (opening lower than the prior day close, creating a gap in the chart).

One might argue that TOL investors are re-evaluating value, which is now near July-level lows. Perhaps it's just technical buying keying the shares' rise due to that base set in July. TOL also serves a higher-end clientele and those folks are suppose to have adequate wealth to endure recession. We argue, however, that asset deflation is destroying great swaths of wealth and likely impacting the spending habits of even the rich at this point. Certainly, sales at Saks (NYSE: SKS), Neiman Marcus (NYSE: ) and Nordstrom (NYSE: JWN) indicated so in September. Many high-end retailers, including these three, reported same-store sales down in or near double-digits. So, if the rich aren't buying jewelry or clothing, then why would they pony up the big check for a down payment...

It's entirely possible that TOL is buying back its own shares at these levels, supporting the stock. It's in a capital position that makes this possible, and it benefits from being viewed as the industry leader. We're guessing such a share buyback plan has been approved and is active. HOV is another story; it's only up a dime, and is valued at a level that indicates there are pleny of bets against its survival. The price-to-sales ratio and debt levels look troublesome, should soft industry trends last.

These early cyclicals, which have been well-beaten down, will eventually see their shares rise well-ahead of economic improvement. Timing that change perfectly, however, is no easy feat. Weeding out the survivors and forecasting base level revenues would be a start toward estimating a safe long-term entry point. Even that, however, would not likely spare your heart from bouts of trepidation.

Please see our disclosures at the Wall Street Greek website and author bio pages found there.

0 Comments:

Post a Comment

<< Home