Weekly Initial Jobless Claims Report

We cover the jobless report on a weekly basis at Wall Street Greek and Market Moving News. To see the most recent article and analysis on the subject, please visit our main page.

Weekly Initial Jobless Claims Report

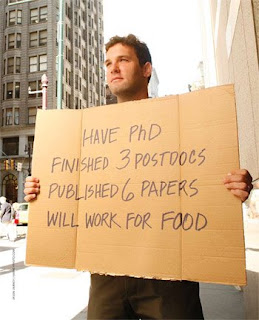

New jobless claimants tallied 461K in the week ended October 11, versus 477K in the prior week period. However, take no comfort from this slight improvement in weekly filings. The labor market outlook is deteriorating, if not already bleak. While unemployment stood at 6.1% at last check, we've witnessed weekly claims rise regularly.

The four-week moving average increased this week again, though by just 750 claims. Also, the total number of insured unemployed increased by 65,750, on a four-week moving average basis. The insured unemployment rate is now up a tenth of a point, to 2.8%. This means that more people are losing jobs than are finding them. What's worse is that this does not discount for individuals who graduate out of the program and yet remain unemployed without benefits.

The Labor Department attributed some of the new unemployment filings to Hurricane Ike (12K filings), but at the same time the effects of Gustav are subsiding. We understand that this is noteworthy, but we also suggest not allowing it to fog the picture. Anecdotal evidence and data offered by other reports provide all the more reason to be concerned about the jobs outlook. For instance, today's check on industrial productivity and capacity utilization illustrated a recessing economy. Also, recent corporate releases from the likes of Pepsico (NYSE: PEP), Daimler (NYSE: DAI), Barclays (NYSE: BCS), eBay (Nasdaq: EBAY), HSBC (NYSE: HBC), Reynold's America (NYSE: RAI) and many others offers evidence of deterioration both in the U.S. and beyond. Besides these corporate announcements of labor cuts, there's been an abundance of corporate failures and consolidations that will also compound upon the unemployment rate.

The highest insured unemployment rates in the week ending Sept. 27 were in Puerto Rico (5.3 percent), California (3.2), Michigan (3.2), Nevada (3.2) and Oregon (3.2). The largest increases in initial claims for the week ending Oct. 4 were in Ohio (+7,217), California (+6,003), Michigan (+5,661), Florida (+4,253), and Alabama (+3,471), while the largest decreases were in Texas (-21,249), Louisiana (-5,461), Mississippi (-1,108), Washington (-809), and Kentucky (-525). The excessive job loss in Ohio and Michigan were auto industry related, while California noted most were service sector positions.

We've heard forecasts on the street of between 7% to 9+% unemployment before this recession is all said and done. Imagine one out of every ten of your peers could be out of work shortly. This is why I advise the average American to buckle down and put a few dollars away for safe keeping if you haven't much saved already. Tougher times lie ahead for many of you, so sure up the ship a bit if you can. For those of you couples who never received your economic stimulus checks because of name conflict, good news, the government just released them. There's good news for the rest of you as well. There's talk of more tax breaks ahead, and possibly another reimbursement to keep us afloat. Keep your chin up, and keep moving forward. This too shall pass.

(Article interests: NYSE: RHI, NYSE: KFY, NYSE: MAN, AMEX: DIA, AMEX: SPY, Nasdaq: QQQQ, NYSE: NYX, AMEX: DOG, AMEX: SDS, AMEX: QLD, AMEX: XLF, AMEX: IWM, AMEX: TWM, AMEX: IWD, AMEX: SDK)

Please see our disclosures at the Wall Street Greek website and author bio pages found there.

0 Comments:

Post a Comment

<< Home