What is Value?

This is my inaugural column for Wall Street Greek. My perspective is European - Dutch, to be precise. My background may be of more importance though. I am a securities analyst - following telecoms, Internet and media stocks, to be precise. So, I will cover a diverse range of topics, usually around a healthy dose of alphabet soup: FTTH, LTE, WiMAX, etc.

Still, I hope all that doesn't impede me to write stuff that our readers will value.

Speaking of which - value must be among the most misunderstood concepts on and off Wall Street.

Business school taught us how using Market Value is preferable to using Book Value - and how we could use it to make fun of accountants who live in a “rearview mirror” world. All they care about is book or historic values, whereas Market Values reflect (to whichever degree) every single expectation we have - be it earnings expectations or interest rate, inflation or employment rate expectations.

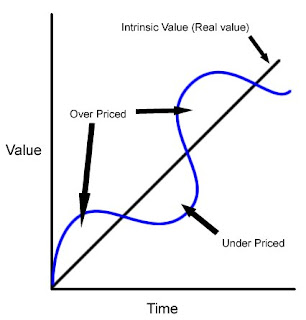

However, there is something beyond Market Value. Market value may be all we "have," but there is something that goes beyond the whims of the market, True Value. The problem with True Value, however, is that we don’t "have" it. All we can do is try to calculate it. And, to make matters worse, the outcomes of such calculations vary from person to person and from day to day.

It is interesting to see how Wall Street adopted the concept of True Value, the outcome of a discounted cash flow (DCF) calculation, over the past 20 years or so. Nowadays, DCF-modelling is part of every decent Wall Street report. It works by discounting all future cash flows of a company at the proper rate (the opportunity cost of capital) and adding them together. Simple! A chimpanzee can do it. And so can Wall Street analysts. (Now, it remains to be seen how well they are done, but that's stuff for another column.)

The thing is, DCF modelling isn’t just a Wall Street toy. And that is where things start to get interesting.

A few years ago, Ad Scheepbouwer, CEO of the Dutch incumbent telco KPN (KPN.AS), complained about the share price of his company. He said that the Market Value was much too low and didn’t reflect all of KPN’s opportunities. More recently Ben Verwaayen, the Dutch CEO of the British incumbent telco BT Group Plc (NYSE: BT), in an interview with a local Dutch newspaper, commented that he didn’t have any opinion on BT’s share price, a.k.a. Market Value.

How come these two people have such different views, and ways of talking about Market Value? The answer is easy: Ben is doing his job (until his departure, May 31), trying to maximize the True Value of BT, whereas, Ad is more concerned with "share price management," in our opinion. Unless of course Ad was referring to a DCF calculation he did (in a spare moment, when he wasn’t maximizing KPN’s True Value). Who knows... But then there is very little point in being frustrated over the Market Value. In places like Wall Street, one can hear people say that "in due course" the market will recognize the real value, and hence Market Value will approach True Value. The problem is that the True Value, as much as the Market Value, is a moving target.

Still, I hope all that doesn't impede me to write stuff that our readers will value.

Speaking of which - value must be among the most misunderstood concepts on and off Wall Street.

Business school taught us how using Market Value is preferable to using Book Value - and how we could use it to make fun of accountants who live in a “rearview mirror” world. All they care about is book or historic values, whereas Market Values reflect (to whichever degree) every single expectation we have - be it earnings expectations or interest rate, inflation or employment rate expectations.

However, there is something beyond Market Value. Market value may be all we "have," but there is something that goes beyond the whims of the market, True Value. The problem with True Value, however, is that we don’t "have" it. All we can do is try to calculate it. And, to make matters worse, the outcomes of such calculations vary from person to person and from day to day.

It is interesting to see how Wall Street adopted the concept of True Value, the outcome of a discounted cash flow (DCF) calculation, over the past 20 years or so. Nowadays, DCF-modelling is part of every decent Wall Street report. It works by discounting all future cash flows of a company at the proper rate (the opportunity cost of capital) and adding them together. Simple! A chimpanzee can do it. And so can Wall Street analysts. (Now, it remains to be seen how well they are done, but that's stuff for another column.)

The thing is, DCF modelling isn’t just a Wall Street toy. And that is where things start to get interesting.

A few years ago, Ad Scheepbouwer, CEO of the Dutch incumbent telco KPN (KPN.AS), complained about the share price of his company. He said that the Market Value was much too low and didn’t reflect all of KPN’s opportunities. More recently Ben Verwaayen, the Dutch CEO of the British incumbent telco BT Group Plc (NYSE: BT), in an interview with a local Dutch newspaper, commented that he didn’t have any opinion on BT’s share price, a.k.a. Market Value.

How come these two people have such different views, and ways of talking about Market Value? The answer is easy: Ben is doing his job (until his departure, May 31), trying to maximize the True Value of BT, whereas, Ad is more concerned with "share price management," in our opinion. Unless of course Ad was referring to a DCF calculation he did (in a spare moment, when he wasn’t maximizing KPN’s True Value). Who knows... But then there is very little point in being frustrated over the Market Value. In places like Wall Street, one can hear people say that "in due course" the market will recognize the real value, and hence Market Value will approach True Value. The problem is that the True Value, as much as the Market Value, is a moving target.

Please see our disclosure at the bottom of the Wall Street Greek website, and Tim's disclosure on his profile page found through his name atop the article. (For readers: NYSE: BT, Nasdaq: FSCTX, Amsterdam: KPN.AS, AMEX: DIA, AMEX: SPY, Nasdaq: QQQQ)

0 Comments:

Post a Comment

<< Home