Stocks Driving on ECB Hope and Fumes

A second day light of U.S. economic data is focusing market attention overseas and on the corporate wire Tuesday. Approaching 10:30 AM EDT, the SPDR S&P 500 (SPY) was up 0.7%, the SPDR Dow Jones Industrial Average (DIA) had gained 0.6% and the PowerShares QQQ (QQQ) was higher by 0.7%.

Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.

Overseas Drivers

As for the overseas drivers, the news is neatly negative. The well-organized demise of Europe was evident again today in data out of Italy and Germany. Italy’s second quarter GDP shrank by 0.7%, leaving the economy 2.5% smaller than it was in Q2 2011. It was the fourth consecutive quarter of recession for Italy, which is surely weighing on the entire region. As for the Germans, they saw industrial orders fall by 1.7% in June, taking those down 7.8% against the prior year. You might have imagined German and Italian shares would be leading stocks lower Tuesday, but the iShares MSCI Italy Index (EWI) and the iShares MSCI Germany Index (EWG) are much higher today. The reason for European energy today is hinged upon the expectation (or hope) of European Central Bank (ECB) action.

International Markets

Economic Data Drivers

The two regular weekly same-store sales data points, from the International Council of Shopping Centers (ICSC) and Redbook, reached the wire Tuesday morning. ICSC’s report showed no change in week-to-week sales for the period ending August 4. This follows the prior week’s 1.7% decline, and so my latest concern about the poor consumer spending trend developing sure looks warranted. On a year-to-year basis, sales increased 1.4% in the period, but that does not even edge inflation. Redbook saw the year-to-year sales change at 2.0% for the same period.

The Federal Reserve Chairman will be busy again Tuesday, this time addressing educators from across the country via a town hall meeting style event at 2:30 PM EDT. We’re not expecting any new information to reach the wire, but the market will be paying attention Bernanke just in case; so you need to as well.

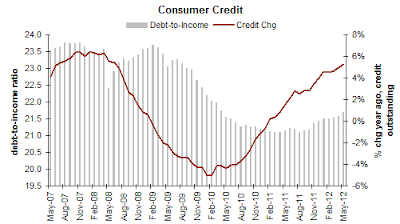

When monthly Consumer Credit data reaches the wire at 3:00 PM EDT Tuesday, be hopeful for a stronger expansion. However, economists expect an increase of $10.3 billion in consumer credit for the month of June. In May, credit expanded by $17.1 billion. The situation has improved dramatically from early 2010, when consumer credit was deeply contracting. Though, whether we’re getting back to our old ways of giving money away or not is another question.

Corporate Events

Two separate New York City conferences today, at Credit Suisse (NYSE: CS) and Jefferies Group (NYSE: JEF), highlight industrial companies.

The corporate earnings wire highlights reports from Walt Disney (NYSE: DIS), Boeing (NYSE: BA), Cablevision (NYSE: CVC), CVS Caremark (NYSE: CVS), Express Scripts (Nasdaq: ESRX), Emerson Electric (NYSE: EMR), Marsh & McLennan (NYSE: MMC), Amerigas Partners (NYSE: AMU), Anthera Pharmaceuticals (Nasdaq: ANTH), Asta Funding (Nasdaq: ASFI), Beacon Roofing (Nasdaq: BECN), Breitburn Energy Partners (Nasdaq: BBEP), Buckeye Technologies (NYSE: BKI), Charles River Laboratories (NYSE: CRL), Charter Communications (Nasdaq: CHTR), Chiquita Brands (NYSE: CQB), Church & Dwight (NYSE: CHD), Coeur d’Alene Mines (NYSE: CDE), Compugen (Nasdaq: CGEN), Cree (Nasdaq: CREE), DemandMedia (NYSE: DMD), EMCORE (Nasdaq: EMKR), Expeditors Int’l (Nasdaq: EXPD), Fossil (Nasdaq: FOSL), GSI Group (Nasdaq: GSIG), Hecla Mining (NYSE: HL), Infinity Pharmaceuticals (Nasdaq: INFI), Insmed (Nasdaq: INSM), Molson Coors (NYSE: TAP), Nanosphere (Nasdaq: NSPH), Nordic American Tanker (NYSE: NAT), Office Depot (NYSE: ODP), Orasure Technologies (Nasdaq: OSUR), PC Mall (Nasdaq: MALL), PG&E (NYSE: PCG), Priceline.com (Nasdaq: PCLN), Primerica (NYSE: PRI), Rand Logistics (Nasdaq: RLOG), Renren (Nasdaq: RENN), Rosetta Resources (Nasdaq: ROSE), Sapient (Nasdaq: SAPE), Sirius XM Radio (Nasdaq: SIRI), Sotheby’s (NYSE: BID), Spectrum Brands (NYSE: SPB), Strattec Security (Nasdaq: STRT), Tenet Healthcare (NYSE: THC), TravelCenters (NYSE: TA), Vitamin Shoppe (NYSE: VSI), Vivus (Nasdaq: VVUS), XL Group (NYSE: XL), Zillow (NYSE: Z) and many more.

(NYSE: DIS), Boeing (NYSE: BA), Cablevision (NYSE: CVC), CVS Caremark (NYSE: CVS), Express Scripts (Nasdaq: ESRX), Emerson Electric (NYSE: EMR), Marsh & McLennan (NYSE: MMC), Amerigas Partners (NYSE: AMU), Anthera Pharmaceuticals (Nasdaq: ANTH), Asta Funding (Nasdaq: ASFI), Beacon Roofing (Nasdaq: BECN), Breitburn Energy Partners (Nasdaq: BBEP), Buckeye Technologies (NYSE: BKI), Charles River Laboratories (NYSE: CRL), Charter Communications (Nasdaq: CHTR), Chiquita Brands (NYSE: CQB), Church & Dwight (NYSE: CHD), Coeur d’Alene Mines (NYSE: CDE), Compugen (Nasdaq: CGEN), Cree (Nasdaq: CREE), DemandMedia (NYSE: DMD), EMCORE (Nasdaq: EMKR), Expeditors Int’l (Nasdaq: EXPD), Fossil (Nasdaq: FOSL), GSI Group (Nasdaq: GSIG), Hecla Mining (NYSE: HL), Infinity Pharmaceuticals (Nasdaq: INFI), Insmed (Nasdaq: INSM), Molson Coors (NYSE: TAP), Nanosphere (Nasdaq: NSPH), Nordic American Tanker (NYSE: NAT), Office Depot (NYSE: ODP), Orasure Technologies (Nasdaq: OSUR), PC Mall (Nasdaq: MALL), PG&E (NYSE: PCG), Priceline.com (Nasdaq: PCLN), Primerica (NYSE: PRI), Rand Logistics (Nasdaq: RLOG), Renren (Nasdaq: RENN), Rosetta Resources (Nasdaq: ROSE), Sapient (Nasdaq: SAPE), Sirius XM Radio (Nasdaq: SIRI), Sotheby’s (NYSE: BID), Spectrum Brands (NYSE: SPB), Strattec Security (Nasdaq: STRT), Tenet Healthcare (NYSE: THC), TravelCenters (NYSE: TA), Vitamin Shoppe (NYSE: VSI), Vivus (Nasdaq: VVUS), XL Group (NYSE: XL), Zillow (NYSE: Z) and many more.

Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.

On ECB Hope & Fumes

Overseas Drivers

As for the overseas drivers, the news is neatly negative. The well-organized demise of Europe was evident again today in data out of Italy and Germany. Italy’s second quarter GDP shrank by 0.7%, leaving the economy 2.5% smaller than it was in Q2 2011. It was the fourth consecutive quarter of recession for Italy, which is surely weighing on the entire region. As for the Germans, they saw industrial orders fall by 1.7% in June, taking those down 7.8% against the prior year. You might have imagined German and Italian shares would be leading stocks lower Tuesday, but the iShares MSCI Italy Index (EWI) and the iShares MSCI Germany Index (EWG) are much higher today. The reason for European energy today is hinged upon the expectation (or hope) of European Central Bank (ECB) action.

International Markets

EUROPE

|

ASIA

|

EURO STOXX 50: +1.5%

|

S&P/ASX 200: +0.4%

|

German DAX: +0.7%

|

Hang Seng: +0.4%

|

FTSE MIB (Italy): +2.3%

|

Nikkei 225: +0.9%

|

FTSE 100: +0.1%

|

Shanghai Shenzhen CSI 300: +0.1%

|

Economic Data Drivers

The two regular weekly same-store sales data points, from the International Council of Shopping Centers (ICSC) and Redbook, reached the wire Tuesday morning. ICSC’s report showed no change in week-to-week sales for the period ending August 4. This follows the prior week’s 1.7% decline, and so my latest concern about the poor consumer spending trend developing sure looks warranted. On a year-to-year basis, sales increased 1.4% in the period, but that does not even edge inflation. Redbook saw the year-to-year sales change at 2.0% for the same period.

The Federal Reserve Chairman will be busy again Tuesday, this time addressing educators from across the country via a town hall meeting style event at 2:30 PM EDT. We’re not expecting any new information to reach the wire, but the market will be paying attention Bernanke just in case; so you need to as well.

When monthly Consumer Credit data reaches the wire at 3:00 PM EDT Tuesday, be hopeful for a stronger expansion. However, economists expect an increase of $10.3 billion in consumer credit for the month of June. In May, credit expanded by $17.1 billion. The situation has improved dramatically from early 2010, when consumer credit was deeply contracting. Though, whether we’re getting back to our old ways of giving money away or not is another question.

Corporate Events

Two separate New York City conferences today, at Credit Suisse (NYSE: CS) and Jefferies Group (NYSE: JEF), highlight industrial companies.

The corporate earnings wire highlights reports from Walt Disney

Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Labels: Market-Outlook, Market-Outlook-2012-Q3

0 Comments:

Post a Comment

<< Home