Bernanke on Small Business 11-09-11

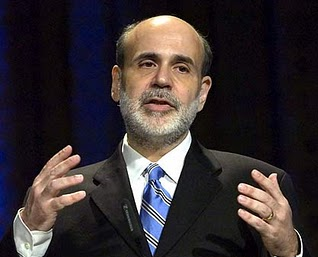

What follows is a verbatim copy of the speech given today by Federal Reserve Chairman Bernanke on the importance of small business to job creation.

What follows is a verbatim copy of the speech given today by Federal Reserve Chairman Bernanke on the importance of small business to job creation.Chairman Ben S. Bernanke

Welcoming Remarks

At the Conference on Small Business and Entrepreneurship during an Economic Recovery, Federal Reserve Board, Washington, D.C.

November 9, 2011

Relative Tickers: NYSE: RHI, NYSE: KFY, NYSE: MAN, NYSE: MWW, Nasdaq: KELYA, Nasdaq: JOBS, NYSE: JOB, Nasdaq: CECO, Nasdaq: PAYX, NYSE: ASF, Nasdaq: KFRC, NYSE: TBI, NYSE: DHX, NYSE: SFN, NYSE: CDI, Nasdaq: CCRN, Nasdaq: ASGN, NYSE: AHS, Nasdaq: BBSI, Nasdaq: HHGP, NYSE: SRT, Nasdaq: RCMT, Nasdaq: VSCP, OTC: ASRG.OB, OTC: MCTH.OB, OTC: IGEN.OB, OTC: STJO.OB, OTC: TNUS.OB, Nasdaq: TSTF, OTC: STTH.PK, OTC: PSRU.OB, OTC: CRRS.OB.

Bernanke Speech on Small Business

Good morning. Welcome to the Federal Reserve Board and today's conference, "Small Business and Entrepreneurship during an Economic Recovery." Let me begin by thanking the Federal Reserve Bank of Atlanta and the Ewing Marion Kauffman Foundation, both of which have cooperated closely with the Board of Governors in organizing this event. This meeting is indeed an eclectic one, bringing together small business owners, lenders, technical assistance providers, government officials, and members of the academic community to explore the challenges faced by today's entrepreneurs and to identify promising approaches to addressing their needs. Events such as this one are particularly valuable because they allow us to draw on a broad range of experiences and evidence. We are keenly interested in hearing your insights and look forward to sharing results from the Federal Reserve's continued small business outreach and research efforts.

Some of you may have attended a forum here last year that focused on credit access for small businesses.1 We hope to advance that discussion today by exploring not only the financing needs of creditworthy small businesses, but also the role these firms could play in creating jobs during these difficult economic times. We will also discuss the unique challenges faced by women- and minority-owned firms. We hope to be as concrete and practical as possible; for example, several conference papers assess the extent to which training, technical assistance, and other resources are available to support these and other small firms. The ultimate goal of this meeting is to learn more about how best to support both small businesses and their communities--to understand what works and what doesn't.

Importance of Small Businesses to the Economy

It's no secret that the past few years have been very difficult for many small firms. They have faced weak sales, diminished asset values, elevated uncertainty, and tight credit market conditions. Many small business owners have had to lay off employees or defer hiring. And many potential entrepreneurs with plans to start new businesses have put those plans on hold.

The role of small businesses and entrepreneurship in job creation will be discussed in our first panel today. As many of you are aware, small businesses have played an important role in fueling past economic recoveries. We need to think carefully about how, in the current economic environment, our nation can best provide small businesses and entrepreneurs with the support they need to expand job opportunities.

Small businesses also help our country compete globally; they often offer a level of agility in bringing innovative products to the global marketplace that larger firms cannot match. At home, many entrepreneurs do more than provide important goods and services--they and their businesses help sustain the vitality of the neighborhoods in which they live and work. Frequently, small business owners demonstrate their commitment to their communities by serving in leadership positions in local schools, volunteering for local nonprofit organizations, and engaging in civic affairs.

For many people, starting a small business is an opportunity to follow one's particular dream. We should recognize that it can also be an important option for people confronting economic challenges in their lives, such as insufficient retirement savings. A study conducted by the Kauffman Foundation suggests that both baby boomers and older generations are increasingly turning to entrepreneurial activities.2 Tomorrow's discussion will pay special attention to how these and other new entrepreneurs are adjusting to the changing landscape of financial services.

Federal Reserve Efforts to Support Small Businesses

The Federal Reserve System is committed to supporting small business and entrepreneurship. We do that, for example, through research that adds to our stock of knowledge about the catalysts for and barriers to entrepreneurship, and through outreach programs to help small business owners and other community stakeholders gain access to a range of financing and technical assistance.

For instance, in a recent forum sponsored by the Federal Reserve System and held in Jacksonville, Florida, both small business owners and their lenders stressed that it takes more than an enterprising spirit to succeed; entrepreneurs also must seek appropriate training and resources. Forum participants emphasized the need to support organizations that offer valuable technical assistance and training programs, including state and regional economic development offices, small business development centers, community colleges, technical schools, and rural cooperative extension offices. Similar forums in Chicago, Atlanta, and Denver--conducted by the Federal Reserve in cooperation with the Opportunity Finance Network, a national trade association for community development financial institutions (CDFIs)--highlighted examples of banks working closely with community development loan funds and other CDFIs to streamline client referral processes to match small businesses with appropriate lenders. Our regional meetings also focused on providing capital and support services to minority-owned small businesses. Through research and analytical efforts, we are working to deepen our understanding of credit market conditions facing small and new businesses, particularly the frictions that impede the flow of credit to creditworthy borrowers. In addition, some of our community development offices conduct regional surveys to obtain a better understanding of the characteristics and financing needs of small business owners in their areas. You will hear more about their findings during the second panel today.

The Federal Reserve also continues to encourage bank examiners to adopt a balanced approach to reviewing banks' lending to small businesses. We hold training sessions for examiners and extend outreach to lenders to promote awareness about both the credit environment and available lending guidance and resources. We would like to foster an environment in which lenders do all they can to meet the needs of creditworthy borrowers while maintaining appropriately prudent underwriting standards.

Closing Observations

The issues you will be discussing today and tomorrow are critical to everyone with an interest in the success of our nation's small firms and entrepreneurs, and, by extension, of our economy as a whole. Based on the wide variety of perspectives represented at today's conference, I feel sure you won't agree on the answers to all the many questions that will be raised. But the dialogue itself is of great value. We at the Federal Reserve have found that conferences such as this one help us to more effectively conduct our outreach and analytical work. We hope that each of you will find this experience worthwhile as well. Thank you in advance for sharing your insights about the challenges for small businesses, and I look forward to seeing the results of your work.

1. More information on "Addressing the Needs of Small Businesses," held July 12, 2010, is available on the Board's website at www.federalreserve.gov/newsevents/conferences/asfbconf.htm. Return to text

2. See Dane Stangler (2009), The Coming Entrepreneurship Boom (Kansas City, Mo.: Ewing Marion Kauffman Foundation).

Article should interest investors in Paychex (Nasdaq: PAYX), Manpower (NYSE: MAN), Robert Half International (NYSE: RHI), 51Job Inc. (Nasdaq: JOBS), Monster World Wide (NYSE: MWW), Korn/Ferry International (NYSE: KFY), Administaff (NYSE: ASF), Kforce (Nasdaq: KFRC), TrueBlue (NYSE: TBI), Dice Holdings (NYSE: DHX), Kelly Services (Nasdaq: KELYA), CDI Corp. (NYSE: CDI), Cross Country Healthcare (Nasdaq: CCRN), On Assignment (Nasdaq: ASGN), AMN Healthcare Services (NYSE: AHS), Barrett Business Services (Nasdaq: BBSI), Hudson Highland Group (Nasdaq: HHGP), StarTek (NYSE: SRT), RCM Technologies (Nasdaq: RCMT), VirtualScopics (Nasdaq: VSCP), American Surgical (OTC: ASRG.OB), Medical Connections (OTC: MCTH.OB), iGen Networks (OTC: IGEN.OB), St. Joseph (OTC: STJO.OB), General Employment Enterprises (NYSE: JOB), Total Neutraceutical (OTC: TNUS.OB), TeamStaff (Nasdaq: TSTF), Stratum (OTC: STTH.PK), Purespectrum (OTC: PSRU.OB), Corporate Resource Services (OTC: CRRS.OB).

Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Labels: Federal_Reserve

0 Comments:

Post a Comment

<< Home