Prospecting for Hope in Mortgage Activity & Services Survey

Today's Market Insights

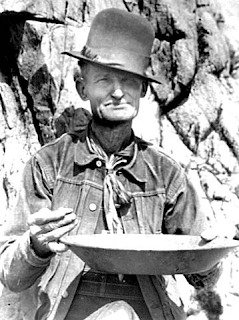

Once you get past the latest bad news about same-store sales, you might find some lustrous pebbles in the Mortgage Activity data and within the Quarterly Services Survey, covered in the paragraphs below. "The Greek" finds some gold in the latest reports.

Our founder earned clients a 23% average annual return over five years as a stock analyst on Wall Street. "The Greek" has written for institutional newsletters, Businessweek, Real Money, Seeking Alpha and others, while also appearing across TV and radio. While writing for Wall Street Greek, Mr. Kaminis presciently warned of the financial crisis.

(Tickers: NYSE: DIA, NYSE: SPY, Nasdaq: QQQQ, NYSE: DOG, NYSE: SDS, NYSE: QLD, NYSE: NYX, NYSE: ICE, Nasdaq: NDAQ, NYSE: MS, OTC: NSRGY.PK, NYSE: HPQ, Nasdaq: DELL, Nasdaq: FSLR, Nasdaq: ALTR, NYSE: PG, NYSE: KO, NYSE: DHR, Nasdaq: CIEN, Nasdaq: FCEA, Nasdaq: HITK, NYSE: JTX, Nasdaq: SHFL, NYSE: SEH, Nasdaq: AVAV, Nasdaq: CLCT, Nasdaq: MEDW, NYSE: MW, NYSE: NAV, Nasdaq: NTWK, NYSE: PBY, NYSE: REX, Nasdaq: DFZ, Nasdaq: RURL, NYSE: SFD, Nasdaq: STRM, NYSE: TLB, Nasdaq: TITN, Nasdaq: UNFI, Nasdaq: VRNT, NYSE: C, NYSE: WFC, NYSE: PNC, NYSE: TD, NYSE: JPM, NYSE: BAC)

Mortgage Activity & Services Survey Offer Hope

If you were hoping for a swing in the tone of economic data this week, well our discerning eye is a bit pleased with what we have found. I should stress "a bit," since the absolute level of activity still stinks, and we had our share of negative news today as well. Namely, the drab data came in the form of same-store sales, which continue to decelerate as comparables from the year ago period normalize. But in the mortgage data, we found a bit of encouragement, if I dare say it. And the services survey released today for Q2 also offered something interesting to note for those of you prospecting for hope.

If you were hoping for a swing in the tone of economic data this week, well our discerning eye is a bit pleased with what we have found. I should stress "a bit," since the absolute level of activity still stinks, and we had our share of negative news today as well. Namely, the drab data came in the form of same-store sales, which continue to decelerate as comparables from the year ago period normalize. But in the mortgage data, we found a bit of encouragement, if I dare say it. And the services survey released today for Q2 also offered something interesting to note for those of you prospecting for hope.Same-Store Sales Suck

The International Council of Shopping Centers (ICSC) reported on weekly same-store sales today instead of Tuesday this week, due to the holiday. Today's release, covering the data through September 4, showed sales dropped 0.4% week-to-week. The yearly comparison showed a measly gain of 1.8%, furthering the trend of a generally decelerating rate of sales growth.

ICSC attributed some blame to the weather, but we know better don't we. Last week's growth amounted to 0.1% week-to-week, and measured against a sharp drop posted the week before. Redbook's data was a bit more positive, but we (and the market) view it less accurate, as it showed a second week of 3.0% growth over the prior year period. Your favorite "Greek" (as if Greeks or Wall Street are favored by anyone these days) has been calling attention to the easy comparables that sales have matched against in the earlier part of the year.

We reiterate: Now that sales are being matched against the results of a more normal state of affairs, the message is clear. Americans are terrified to spend money, if they even have an extra dollar to spend freely.

Traction in Mortgage Activity?

We thought this week's mortgage activity would be worth watching, given the uptick in Purchase Activity in the August 27 period that came on record low mortgage rates. We thought that perhaps we might be finding a rate level where traction could be found for real estate. Well, in retrospect, given the back-to-school skew that childless folks like The Greek sometimes forget about (I was reminded last night by the crowd in Staples (Nasdaq: SPLS)), now might not be the least noiseless moment to measure this data-point.

In any event, in the period ending September 3, mortgage rates ticked back up a bit from record lows (since 1990). Contracted rates on 30-year and 15-year mortgages averaged 4.50% (from 4.43%) and 4.0% (3.88%), respectively. Perhaps partly due to the minute change, the Mortgage Bankers Association reported weekly mortgage applications lost ground last week. The Market Composite Index shed 1.5%, driven by a 3.1% decrease in the Refinance Index.

"...note that the seasonally adjusted Purchase Index jumped 6.3% in the period."

However, note that the seasonally adjusted Purchase Index jumped 6.3% in the period. The pure, unadulterated version of this metric still rose 4.0%. Might this really symbolize a floor? Well, before you get too excited, take account of how far below sea level the floor is, which lends to a risk of flooding. Purchase activity was 38% below the same week from a year ago. This rush might simply be tied to the market sort of sensing a bottom for mortgage rates, or I hope, perhaps might mark the place where traction is found.

Quarter Services Survey

The latest Quarterly Services Survey for the second quarter came due this morning. Well, well, well… First a qualifier: things have deteriorated since June, or gotten better at a slower pace anyhow. Now for the good news: the US Census Bureau reported that overall information services revenue increased 0.8% against Q1, which also recorded revised growth of 0.9%. The best news was in the details though, and please do not miss this, while continuing to remind yourself that the data covers April, May and June, and things are not quite the same now.

The estimate of U.S. transportation and warehousing (including truck transportation, couriers and messengers, and warehousing and storage) revenue for the second quarter of 2010, not adjusted for seasonal variation, or price changes, was $71.5 billion, an increase of 10.0 percent (± 1.2%) from the first quarter of 2010 and up 9.8 percent (± 2.6%) from the second quarter of 2009. This sector is correctly viewed as a pure barometer of economic activity, since it measures business as it is occurring. If things are being shipped, there should be driving demand. We doubt store shelves are being filled on hope at this point. The question remains though, and this is something we have pointed out previously, what percentage of these goods are increasingly from low-cost China, and come at the detriment of US producers. Surely, US consumer sensitivity to price is high now.

Fellow Wall Streeters, there is hope! Okay, it's rather slim hope, but it's hope anyway. The estimate of U.S. finance and insurance revenue for the second quarter of 2010, not adjusted for seasonal variation, or price changes, was $801.6 billion, an increase of 0.1 percent from the first quarter of 2010. The fourth quarter of 2009 to first quarter of 2010 percent change was revised from 0.2 percent to 0.4 percent. Hey, at some point companies might even start hiring us again (or you; I'm not going back there except for a sweet offer or partnership).

Our own prescient Real Estate Analyst, Michael Douville, keeps telling us rental rates are going to increase, and he did it again in his latest write-up last week, "Deflating the Housing Bubble". Well, take heed dear friends, for today's data details his expectations playing out before your eyes. The estimate of U.S. rental and leasing services revenue for the second quarter of 2010, not adjusted for seasonal variation, or price changes, was $31.4 billion, an increase of 13.8 percent (± 2.8%) from the first quarter of 2010.

Perhaps the most fulfilling news came in the Employment Services line item though. Employment Services jumped 5.4% in Q2, and this follows Q1's 5.3% gain. Keep hope alive dear friends. Keep hope alive.

Beige Book

Look for the latest Beige Book at 2 PM. The Fed's latest release should prove interesting to investors looking for a fresh look into Fed insight. Commonly known as the Beige Book, this report is published eight times per year. Each Federal Reserve Bank gathers anecdotal information on current economic conditions in its District through reports from Bank and Branch directors and interviews with key business contacts, economists, market experts, and other sources. The Beige Book summarizes this information by District and sector. An overall summary of the twelve district reports is prepared by a designated Federal Reserve Bank on a rotating basis.

Consumer Credit

Look for the latest check of Consumer Credit at 3:00 PM ET. This report covering the month of July is expected by the consensus of surveyed economists to show a contraction of $3.5 billion. That will compare against the contractions of $1.3 billion in June, $5.3 billion in May and $14.9 billion in April.

Corporate Wire

In corporate news, look for Morgan Stanley's (NYSE: MS) CEO James Gorman to appear before a German bank conference. Nestle (OTC: NSRGY.PK) Chairman Peter Brabeck-Letmathe also addresses an audience Wednesday. The Citigroup Global Technology Conference highlights presentations from Hewlett-Packard (NYSE: HPQ), Dell (Nasdaq: DELL), First Solar (Nasdaq: FSLR) and Altera (Nasdaq: ALTR). The Barclays Back-To-School Consumer Conference highlights presentations by Procter & Gamble (NYSE: PG) and Coca-Cola (NYSE: KO).

Danaher (NYSE: DHR) meets with analysts and the EPS schedule includes news from Ciena (Nasdaq: CIEN), Forest City Enterprises (Nasdaq: FCEA), Hi-Tech Pharmacal (Nasdaq: HITK), Jackson Hewitt Tax Service (NYSE: JTX), Shuffle Master (Nasdaq: SHFL), Spartech (NYSE: SEH), AeroVironment (Nasdaq: AVAV), Collectors Universe (Nasdaq: CLCT), Mediware Information Systems (Nasdaq: MEDW), Men's Wearhouse (NYSE: MW), Navistar International (NYSE: NAV), Netsol Technologies (Nasdaq: NTWK), Pep Boys (NYSE: PBY), REX American Resources (NYSE: REX), RG Barry (Nasdaq: DFZ), Rural/Metro (Nasdaq: RURL), Smithfield Foods (NYSE: SFD), Streamline Health Solutions (Nasdaq: STRM), Talbots (NYSE: TLB), Titan Machinery (Nasdaq: TITN), United Natural Foods (Nasdaq: UNFI) and Verint Systems (Nasdaq: VRNT).

Editor's Note: Article should interest investors in Robert Half (NYSE: RHI), Korn Ferry (NYSE: KFY), Manpower (NYSE: MAN), Monster Worldwide (NYSE: MWW), Bank of America (NYSE: BAC), Freddie Mac (OTC: FMCC.OB), Fannie Mae (OTC: FNMA.OB), Goldman Sachs (NYSE: GS), Morgan Stanley (NYSE: MS), Wells Fargo (NYSE: WFC), Toronto Dominion (NYSE: TD), UltraShort Real Estate ProShares (NYSE: SRS), Ultra Real Estate ProShares (NYSE: URE), ING Clarion Global Real Estate Income Fund (NYSE: IGR), Xinyuan Real Estate Co. (NYSE: XIN), Rydex Real Estate Fund H (Nasdaq: RYHRX), T. Rowe Price Real Estate Fund (Nasdaq: TRREX), Toll Brothers (NYSE: TOL), Hovnanian (NYSE: HOV), D.R. Horton (NYSE: DHI), Beazer Homes (NYSE: BZH), Lennar (NYSE: LEN), K.B. Homes (NYSE: KBH), Pulte Homes (NYSE: PHM), NVR Inc. (NYSE: NVR), Gafisa SA (NYSE: GFA), MDC Holdings (NYSE: MDC), Ryland Group (NYSE: RYL), Meritage Homes (NYSE: MTH), Brookfield Homes (NYSE: BHS), Standard Pacific (NYSE: SPF), M/I Homes (NYSE: MHO), Orleans Homebuilders (AMEX: OHB), Vanguard REIT Index ETF (NYSE: VNQ), PNC Bank (NYSE: PNC), J.P. Morgan Chase (NYSE: JPM), Hooker Furniture (Nasdaq: HOFT), Ethan Allen (NYSE: ETH), Pier 1 Imports (NYSE: PIR), Williams Sonoma (NYSE: WSM), Home Depot (NYSE: HD), Lowes (NYSE: LOW), AMEX: VAZ, AMEX: NKR, AMEX: MZA, AMEX: NXE, AMEX: NFZ, Nasdaq: XNFZX, Nasdaq: FSAZX and Avatar Holdings (Nasdaq: AVTR).

Please see our disclosures at the Wall Street Greek website and author bio pages found there. This article and website in no way offers or represents financial or investment advice. Information is provided for entertainment purposes only.

Labels: Economic Reports, Real Estate

0 Comments:

Post a Comment

<< Home